What’s In Your Cart? Consumer Products Sales During Economic Transitions

Recent inflation readings have shown promise that price increases are returning to the Fed’s 2% target, a positive for the consumer and economy that may allow the Fed to pivot towards rate cuts. Simultaneously, consumer product manufacturers are facing a pivot of their own. Changes in consumer shopping patterns suggest that the resilience consumers touted during the pandemic is wearing thin, which could impact credit conditions in 2024 and 2025.

Where We Started

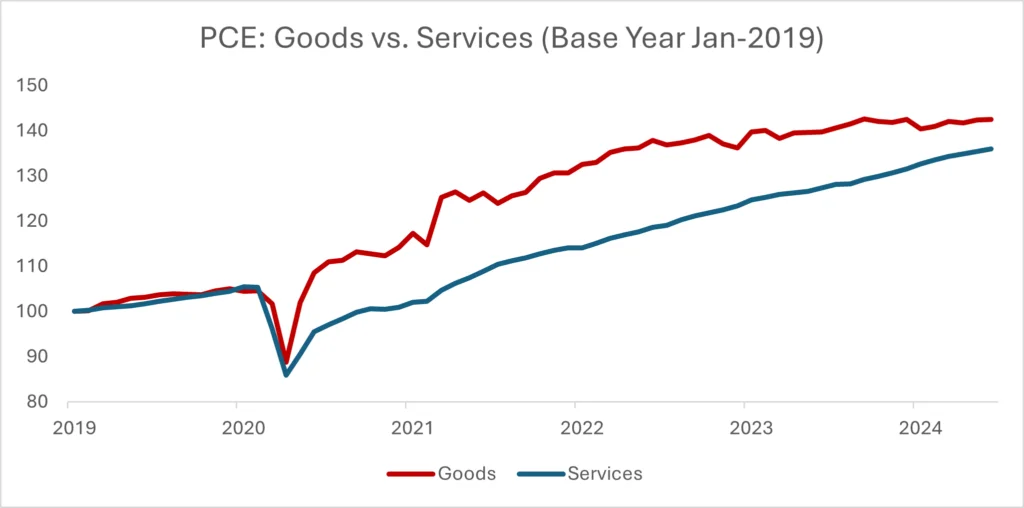

In the spring of 2020, when the Covid-19 pandemic halted travel and global business operations, goods spending surged due to a sizable government stimulus and pandemic restrictions limiting services. Pandemic restrictions and strong demand resulted in overwhelmed supply chains, helping to drive decades-high inflation, which was further exacerbated by commodity inflation related to the Russia-Ukraine conflict.

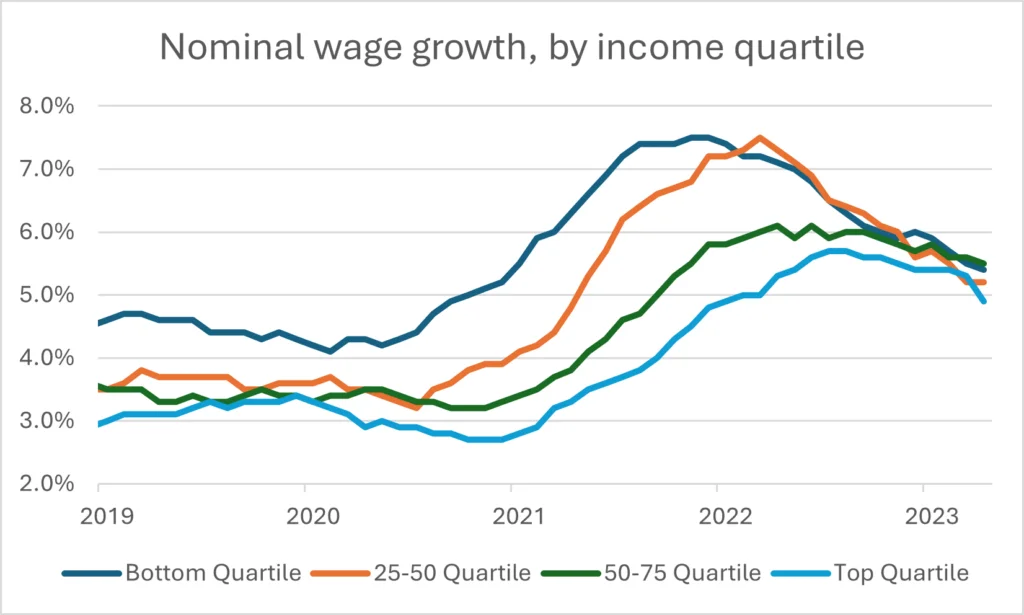

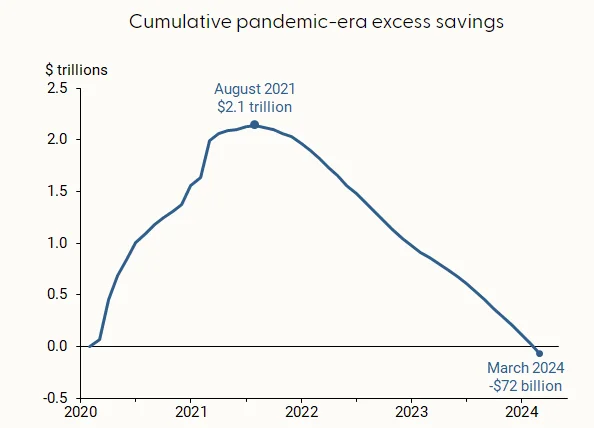

To combat surging price inflation, consumer products companies began to significantly increase prices. However, to the surprise of many, the sticker shock did not substantially deter consumer spending or induce trade-down behavior. Goods spending remained robust as pandemic restrictions eased, and services spending rebounded. This resilience in spending was likely due to a combination of excess savings, a historically strong labor market, and low interest rates. Moreover, an unprecedented level of tightness in the labor market saw wages surge, particularly for low-income workers. If those paychecks were already spent, consumers could borrow at low interest rates. In short, the pandemic was a perfect tailwind for goods spending.

Source: Bureau of Economic Analysis

Source: Atlanta Fed Wage Growth Tracker – 12 month moving averages of monthly median wage growth for each average wage quartile

What Happened

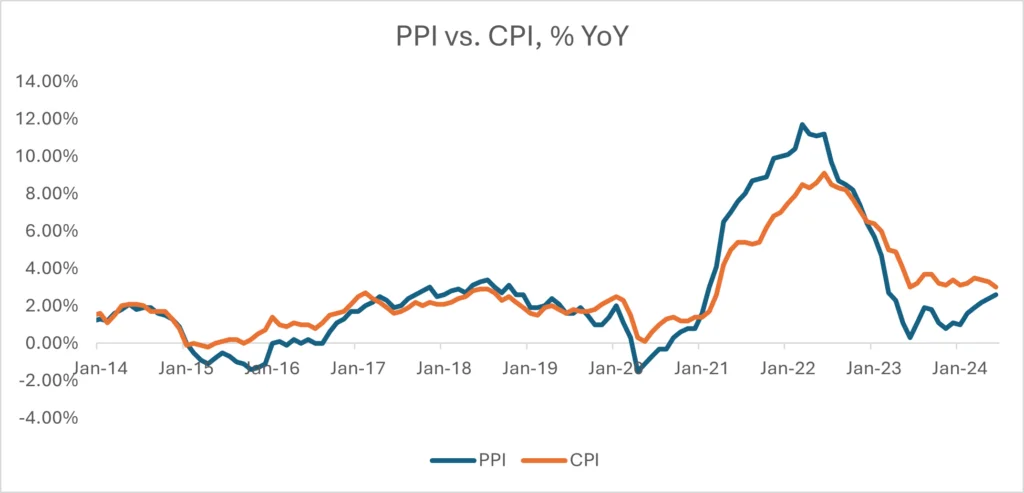

For consumer product companies, the inflationary environment had mixed results. On the plus side, revenue growth was high, reflecting elevated price increases and relatively strong volumes. On the other hand, though these companies were occasionally labeled “price gougers,” profitability broadly declined as input cost inflation exceeded final goods and services price inflation. Comparing the Consumer Price Index (CPI) to the Producer Price Index (PPI) further illustrates this, with cost increases for inputs exceeding those charged to the consumer between January 2021 and November 2022. While margin pressure demanded attention, producers could take solace in the fact that people were seemingly spending no matter what.

Source: Bureau of Economic Analysis

Where We Are Now

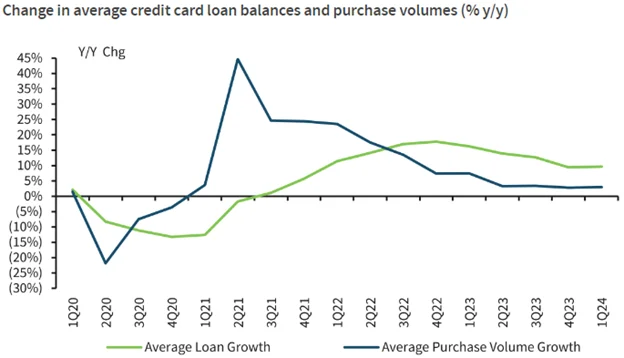

All good things must come to an end, as did the pandemic tailwinds. By the second half of 2023, excess savings were largely depleted. The rapid rise of interest rates reduced consumers’ ability and propensity to borrow. Additionally, loosening labor market conditions led to normalized wage growth and an increase in the unemployment rate in the first half of 2024. Consumers began to push back by trading down to lower-tier products or switching to private label products. While the worst of the price hikes are over, the consumer is still sensitive in their retail spending.

Source: Federal Reserve Bank of San Francisco

Source: Barclays Research

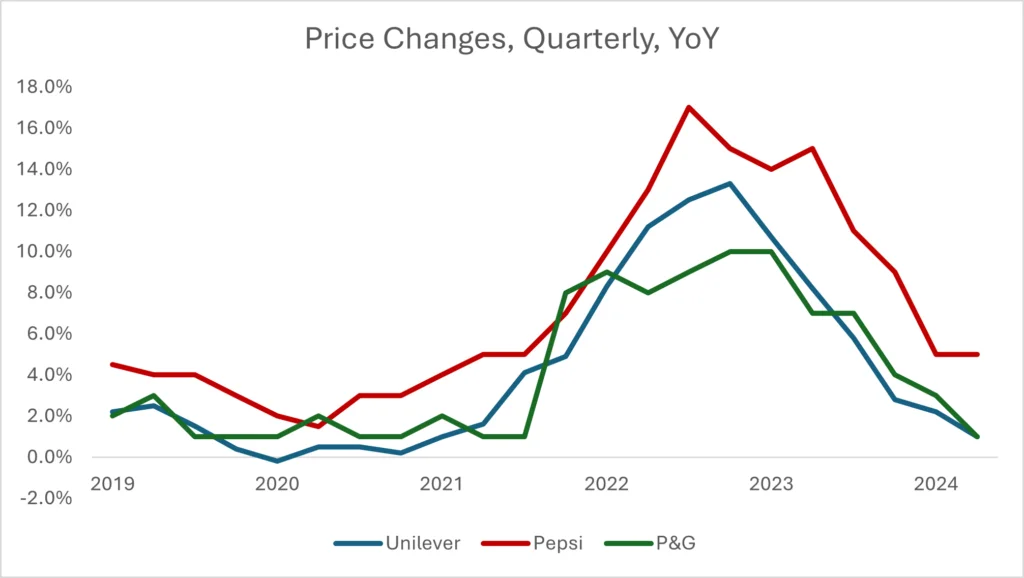

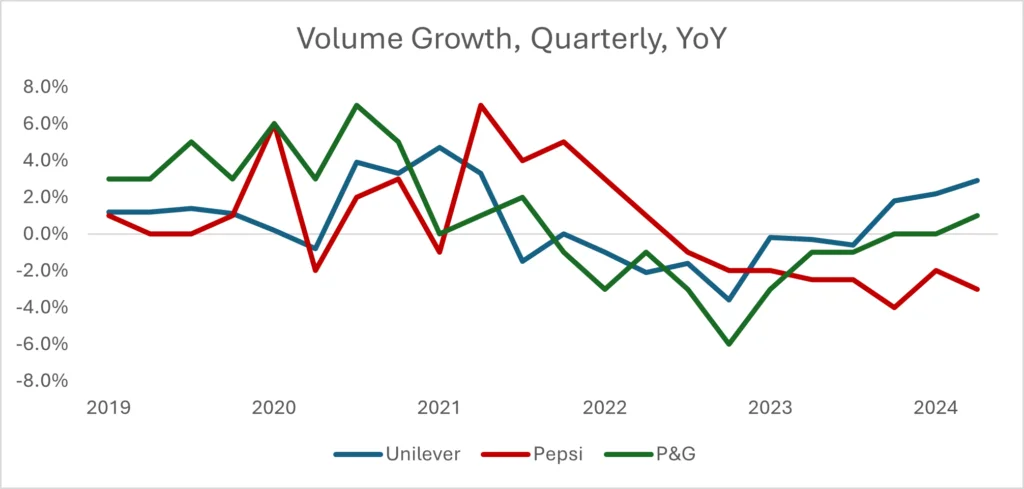

To illustrate the impact of consumer behavior on staple goods, one can observe the impact of price increases and volume shipments as contributors to organic sales growth. Around the time of the pandemic, organic sales growth jumped mainly due to higher volume shipments while prices remained muted. As costs surged, so did their prices. These offset the decline in sales volumes. Even when price growth slowed, volumes recovered but not to the same extent, bringing revenue expectations back to Earth. Take for instance Unilever, Pepsi, and Procter & Gamble. While these companies vary in their product and geographic mix, all three companies broadly follow the same pattern in terms of price and volume changes.

Source: Company Filings

Should Investors Be Concerned?

Despite headwinds causing households to lower consumption, there is still reason to be optimistic about the credit quality of large, diversified consumer product companies. While the trajectory of revenue growth has broadly declined, the trajectory of cost pressures, both for commodities and labor, has also decreased. Though generally below pre-pandemic levels, this has led to improvements in profitability. Nonetheless, producers of consumer staples appear to have staved off the worst of inflationary challenges.

Moreover, while consumer health is currently strong despite the higher rate environment, investment-grade consumer staples producers are prepared if the economy takes a turn for the worst. Generally, these companies’ brands are structured to capture multiple price points for the same segments. For example, while Procter & Gamble may market Tide and Bounty as premium laundry detergents, they also own lower-priced brands like Cheer and Era, which offer a trade-down alternative. Moreover, consumer staples are, as the name implies, generally demand-inelastic, meaning that even in particularly poor economic conditions, business will remain more stable relative to other cyclical industries. That being said, this does not mitigate the likely impact on volumes and profitability. While trade-down activity may be a headwind to profit margins, having a diversified product portfolio may help keep cash flows relatively stable.

Conclusion

As uncertainty weighs over the magnitude of slowing economic activity and consumers’ financial condition, consumer products companies may pose a good opportunity for cash investors looking for relatively safe investments. Continued disinflation has translated into positive momentum for profitability, even as revenue growth slows. Given product diversity and positioning in a stable sector, consumer staples may offer cash investors an opportunity to invest in highly-rated credits with predictable cash flows through the economic cycle. As the Fed appears likely to lower interest rates later this year, this is particularly beneficial for investors seeking to extend their portfolio duration

Ultimately, individual credit quality will likely be driven by the ability to restore sales volumes, mainly through cost management. Companies with less aggressive pricing and a product portfolio that offers more trade-down options are likely to fare better than those with relatively higher price increases and weaker alternatives to private label competition.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.