July Mid-Month Portfolio Update

Return of the Dual Mandate

“For a long time, the risks were more that we would fail to hit our inflation target…. we’re very much aware that we have two-sided risks now.” This was a quote from Federal Reserve Chair Powell when he spoke to Congress last week, acknowledging that elevated inflation “is not the only risk we face” and he has seen that “the labor market has cooled really significantly across so many measures.” He pointed out that keeping policy too restrictive “could unduly weaken economic activity and employment”, signaling that the Fed may be increasingly open to rate cuts in the short-term. Powell’s comments regarding labor-market risks highlight a pivot back to the Fed’s dual mandate by placing equal weight on both maximum employment and price stability instead of focusing exclusively on reducing inflation. During a subsequent speech on 7/15, Powell again acknowledged this pivot by saying the Fed is now looking at both mandates.

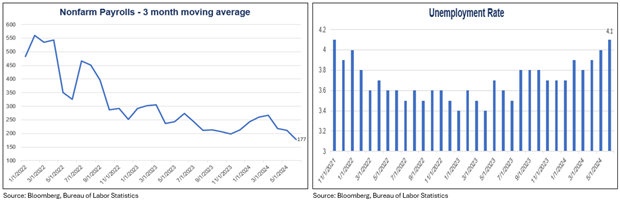

Although headline nonfarm payrolls for June came in higher than expected, overall payroll growth has slowed with a combined -111,000 of downward revisions for the past two months’ readings. The three-month moving average for nonfarm payrolls has declined to 177,000, the slowest in over two years. In addition, the unemployment rate has climbed for the past 3 months from 3.7% to 4.1% and is up by 0.5% over the past year. (see charts below)

Improving CPI Clears Path for September Rate Cut

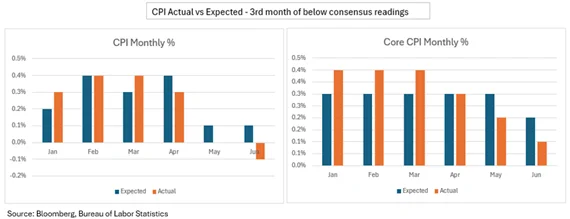

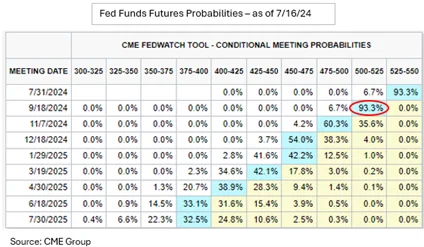

The Consumer Price Index (CPI) declined in June and provides “more good data” that Fed officials have been hoping to see. The first quarter of 2024 saw higher than expected CPI prints while the second quarter saw lower than expected prints (see chart below). This improvement has increased the chance the Fed will soon start cutting rates; the Fed Funds Futures market is pricing in over a +90% probability the Fed will lower rates (see chart below) by its September meeting.

- Headline CPI saw its first monthly negative decline since 2020 at -0.1%.

- The Core CPI monthly June reading of +0.1% was the smallest advance in 3 years.

- The yearly readings continue to decline with headline CPI falling to +3% while Core CPI fell to 3.3%.

- The 3-month annualized Core CPI is up +2.1%, the lowest since March 2021, but the 6-month reading is still at a sticky +3.3%.

Steeper Yield Curve Post Biden/Trump Debate

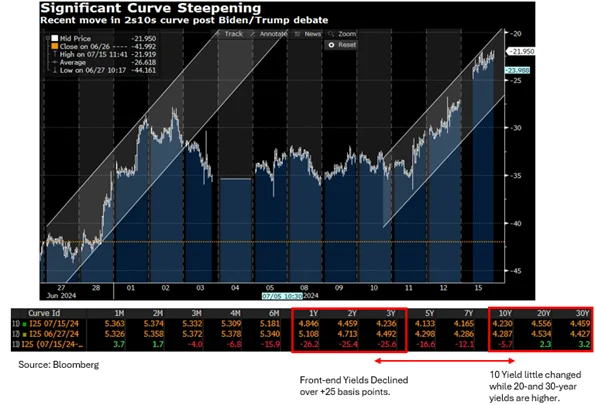

July marks the second anniversary of the 2s10s yield curve inversion (the 2s10s yield curve is a measure of the difference in interest rates between the two-year and ten-year Treasury bonds). However, there has been a noticeable shift in the treasury yield curve with the 2s10s curve seeing some considerable steepening since the Biden/Trump debate at the end of June along with the Supreme Court’s ruling on a presidents’ potential immunity. Although it is still too early to determine the outcome of the election, the likelihood of a Trump victory in November is being viewed as reflationary considering Trump’s proposals for extending tax cuts and implementing significant tariffs as well as the likelihood of increased Treasury issuance regardless of who wins the White House this November. Since the end of June, the curve has steepened from a negative -44bps to -22bps (see chart below).

Please see our latest blog which examines how Trump’s re-election could shape the Fed and its potential impact on the economy: https://www.capitaladvisors.com/what-would-a-second-trump-term-mean-for-the-fed/

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.