Navigating Today’s Venture Debt Landscape: A Guide for CFOs

How to Position Your Company to Lenders in a Challenging Venture Debt Environment.

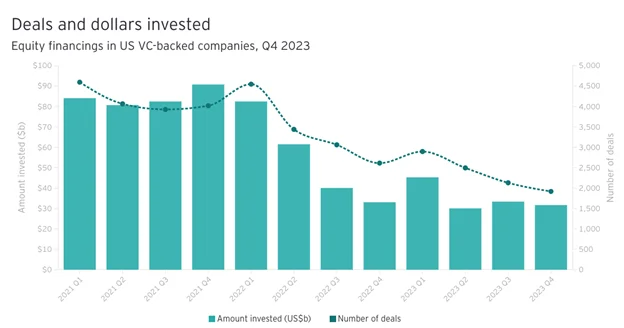

If you are considering venture debt financing to strengthen your balance sheet, extend your cash runway, and minimize equity dilution, understanding the current challenging lending environment will be crucial to your success. In the past two years, higher interest rates, inflation, economic uncertainty, an anemic IPO market, and depressed valuations have put the brakes on venture capital funding. In 2023, venture investments in new companies plummeted by 35% from 2022, and the market has continued to struggle in 2024.

So, it’s no surprise that lenders to venture-backed companies have become more conservative and risk averse. But while raising venture debt can take longer and be somewhat more costly than in recent years, numerous deals are still available for borrowers who prepare properly and understand lenders’ evolving requirements. Following are three significant changes we’ve seen in the venture lending market, along with six tips for navigating this new environment in pursuit of a successful debt transaction.

Figure 1: As venture capital equity investments have plummeted, venture-debt lenders have become more conservative and risk averse1.

Three Changes in The Venture Debt Lending Environment

The most significant recent changes we’ve seen in venture debt have been in the way that lenders view cash burn rates and cash runway requirements. Another interesting trend is that lenders are emphasizing operational results more in their underwriting processes than the characteristics of a company’s venture capital fundraising history.

1.Perspective on Burn Rates

Previously, venture lenders embraced high cash burn rates accompanied by rapid growth, with the understanding that profitability was not a near term priority in many cases. Today, lenders analyze burn rates more closely, preferring a clear path to breakeven within a reasonable timeframe. This is in large part due to uncertainty over whether or not venture capital firms will continue funding high burn companies.

2.Cash Runway Requirements

Another pivotal shift is in cash runway expectations. Lenders are wary of companies that may run out of cash and present near-term challenges within their loan portfolios. While companies with 6-12 months of runway have often been good candidates for debt in the past, many venture lenders are now requiring 12-18 months runway or more.

3.Role of Venture Capital

Equity support from venture capitalists remains an important consideration for venture lenders. However, there has been a noticeable shift toward emphasizing a company’s operational performance over its venture capital story. This reflects the current reality that many companies, even those with strong syndicates, are struggling to raise successively larger follow-on equity rounds at the same cadence that they were able to in the past. That said, it should be noted that when companies do succeed in completing a large equity raise in the current difficult equity environment, it sends a strong positive signal to lenders.

Six Strategies to Attract Lenders

When preparing to approach the market for venture debt, six strategies may enhance your company’s attractiveness to lenders:

- Reduce Burn: Prioritize capital efficiency over high growth, if necessary, to reduce your cash burn rate. Lenders now favor companies that grow sustainably and prudently manage capital.

- Timing Matters: Start coordinating your debt raise shortly after an equity round to maximize momentum and leverage financial strength.

- Prepare Thoroughly: Have a board approved financial model and diligence materials ready before approaching lenders. Due diligence processes have become more rigorous, so being well-prepared can expedite decision-making.

- Articulate a Clear Ask: Define your funding needs clearly and justify them with a solid plan for utilization. Lenders appreciate transparency and strategic foresight. Be prepared to present answers to the questions around sources and uses of capital.

- Broaden Your Approach: Cast a wider net when seeking financing. With lenders being more selective, increasing your initial outreach can improve your chances of securing competitive terms.

- Be Conservative: Keep debt requests moderate relative to your company’s enterprise value, financial profile, and equity track record.

In conclusion, while the venture debt landscape has become more challenging, there are still many venture debt deals happening. By aligning with these insights and preparing diligently, you should be well-positioned to navigate the current environment with confidence and secure the venture debt funding you need to drive growth and innovation.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.