March CPI: Shelter Prices Steal the Show

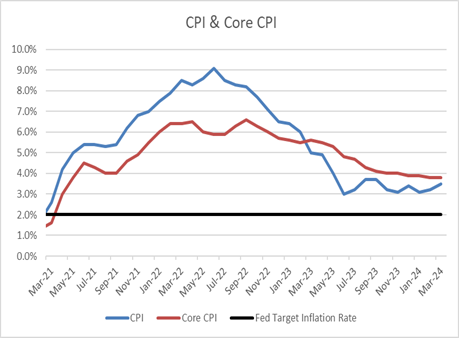

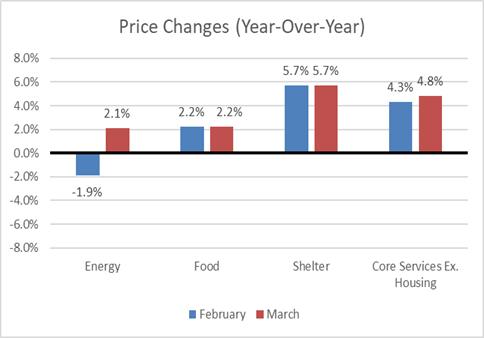

Hotter than expected inflation readings continued in March as headline CPI increased 3.5% year-over-year, 0.3% higher than the yearly increase seen in February, and 0.1% above expectations. Core inflation increased 3.8% year-over-year, in-line with last month’s reading, but also 0.1% above expectations. Energy and shelter prices contributed over 60% of the yearly headline increase. While energy prices tend to be volatile, falling shelter prices have failed to materialize as anticipated, driving inflation higher throughout Q1. However, core services ex housing still increased 4.8% year-over-year, an acceleration from the previous month, and a signal that inflationary pressures remain widespread across the economy.

Inflation has proved to be stubbornly resilient through Q1, presenting a challenge to the Fed’s outlook for three 0.25% interest rate cuts in 2024. Recent Fed speak has signaled that some officials may be upwardly revising their expectations for the Fed Funds Target Range at the end of 2024. Additionally, a reacceleration of inflation combined with the November election cycle may push the Fed to delay rate cuts until late November or December, if at all this year. A surprisingly strong economy has given the Fed greater leeway to focus on bringing inflation towards their 2.0% target. However, if high interest rates begin to impact economic activity and the labor market, it could further complicate the Fed’s outlook and force them to reconsider their policy stance.

Takeaways for Cash Investors

Fed– Fed futures markets have rapidly backed off expectations for rate cuts in 2024. The market is now pricing in a 22% chance of the Fed cutting rates by 0.25% at their July meeting. It’s also currently expecting roughly 0.45% of cuts by the end of the year, a significantly more hawkish outlook than the Fed which expected 0.75% of cuts as of their March meeting. However, strong inflation may soon drive the Fed to communicate less rate cuts than previously anticipated.

Rates– Rates increased across the curve with yield on the 2-year Treasury note rising 0.18% following the release. Yield on the 6-month Treasury bill rose by a smaller 0.06%, while shorter maturity notes remained relatively stable. The moves in the yield curve are consistent with the theory that strong inflation could drive the Fed to keep rates at their current level for longer, and potentially lead the Fed to pursue more gradual cuts.

Credit– Stubbornly high inflation could place greater downward pressure on corporate profit margins and continue to pressure household balance sheets. Additionally, further inflation threatens the possibility of a soft landing as it could force the Fed to keep policy more restrictive, increasing the chances of a policy misstep.

This information was prepared by Capital Advisors Group, Inc. from outside sources which we believe to be reliable. However, we make no representations as to its accuracy or completeness. The economic statistics presented in this report are subject to revision by the agencies that issue them.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.