Six Advantages of Separately Managed Accounts Over Ultra Short Bond Funds

Abstract

In a falling interest rate environment, sensitivity related to uninsured deposits and income preservation argues for consideration of cash management vehicles outside of bank deposits and money market funds. While ultra short bond funds (USBFs) hold promise as potential yield enhancing tools, they may exhibit many of the same issues as prime funds, with additional drawbacks. A well-researched and well-constructed separately managed account (SMA) may overcome these drawbacks and help to deliver benefits comparable to, or better than, these alternatives in a falling rate environment. This whitepaper lists six such advantages for institutional cash accounts.

Six Advantages of Separately Managed Accounts:

- Tailored Risk Management

- Reduced Shared Liquidity Risk

- Transparency

- Low Portfolio Turnover and Simple Tax Considerations

- Income and Capital Gains Management

- Versatile Reporting

Note: Shared liquidity funds and separate accounts need not be mutually exclusive. A stratified portfolio of deposits, government MMFs, SMAs and other alternative cash vehicles may coexist in an overall cash portfolio.

Introduction

Silicon Valley Bank’s failure in March 2023 seared uninsured deposits risk into the collective memory of institutional cash investors. Government money market funds (MMFs) may be a good substitute for overnight deposits but offer little yield protection in a falling interest rate environment.

An effective strategy to preserve portfolio income may be to invest in moderately longer-term debt instruments before the Federal Reserve lowers interest rates. This can be done with private liquidity funds, ultra-short bond funds (USBFs), or exchange traded funds (ETFs). Unlike separately managed accounts (SMAs), pooled investments (including USBFs and prime MMFs) with shared liquidity may be susceptible to confidence erosion that can lead to unexpected runs.

The Separately Managed Account (SMA) vs. Ultra-Short Bond Fund (USBF) Debate

A liquidity survey completed by the Association for Financial Professionals in 2023 shows that, even after the SVB failure, nearly half (47%) of its members’ short-term investments were in bank deposits, and another 23% in government and prime/diversified MMFs.1 If this were to remain true in 2024, it would mean that most institutional treasury accounts would experience significant income reduction as soon as the Fed cuts short-term rates. As a result, it may pay to lock in some yield before the easing cycle starts.

Separately managed account solutions gained more recognition after the 2016 MMF reform among institutional cash managers, as they can hold some of the same securities as prime funds without fluctuating NAVs or redemption “fees and gates.” SMAs also allow customized portfolio construction designed to suit an investor’s unique risk tolerance and income expectations.

Ultra-short bond funds may offer some of the same benefits as separately managed accounts, such as no redemption fees and gates and higher yield potential than prime funds. They have the look and feel of variable NAV prime MMFs, although they are not usually available as daily sweeps. Investors can buy and sell funds daily without having to select an investment manager, open a custody account, or design an investment policy. The question is whether the convenience outweighs the drawbacks in USBFs.

We believe that SMAs hold advantages over pooled liquidity funds such as USBFs in at least six areas.

Separately Managed Accounts (SMA) Basics

With the exception of government money market funds used as a sweep and for upcoming liquidity needs, separately managed account investors own their investments directly, often in a custodial bank account registered in their names. These investors often use professional managers to make investment decisions. Typical SMA investors include corporations, educational endowments, charitable foundations, pension plans and private wealth trusts.

In institutional cash management, SMAs have a long history (more common in pre-MMF years) but a limited recent following. According to the same AFP liquidity survey, less than 5% of institutional short-term portfolios were in SMAs, two-thirds of which use an account manager.

Introducing Ultra-Short Bond Funds (USBF)

The term is a relatively new phenomenon that lacks a standard definition. According to US News and World Report’s mutual fund ranking service, ultra-short bond funds are mutual funds that “invest primarily in investment-grade U.S. fixed income issues and have durations of less than one year (or, if duration is unavailable, average effective maturities of less than one year). Due to their focus on bonds with very short durations, these portfolios offer minimal interest-rate sensitivity and therefore low risk and total return potential.”2

Unlike separately managed account investors’ direct ownership, ultra-short bond fund investors own shares in a fund that buys securities on their behalf. Like SMA investors, USBF investors also use professional managers to make investment decisions.

USBFs as retail products have been around for several decades, seeking income returns higher than MMFs but price volatility less than short-term bond funds. During the 2007-2008 financial crisis, several infamous and defunct “yield plus” funds belonged to this category.3 As mutual funds, they are subject to the Investment Company Act of 1940 and are regulated by the Securities and Exchange Commission (SEC). MMFs are a special class of mutual funds with a Rule 2a-7 exemption from the Investment Company Act.

Institutional USBFs are designed for and marketed to former institutional prime MMF shareholders. They generally replicate the “old Rule 2a-7” product, for example, targeting portfolio weighted average maturity between three and six months, abiding by the 5% issuer concentration limit, keeping maximum issuer maturity under one-year, and refraining from using below investment grade credits. We should caution that these are not required features of USBF, and individual funds may deviate from these norms.

Advantages of Separately Managed Accounts (SMA) over Ultra-Short Bond Funds (USBF)

Many of the potential and obvious advantages of separately managed accounts over ultra-short bond funds reflect individuality and flexibility traits. Since its assets (with the exception of government money market funds that can be used as a sweep) are not commingled with those of other investors, an institutional investor can work with its SMA manager to customize investment strategies and construct a portfolio that fits its own risk tolerance, return expectations and specific cash needs. It is also free from the “hot money” issue among institutional prime MMFs.

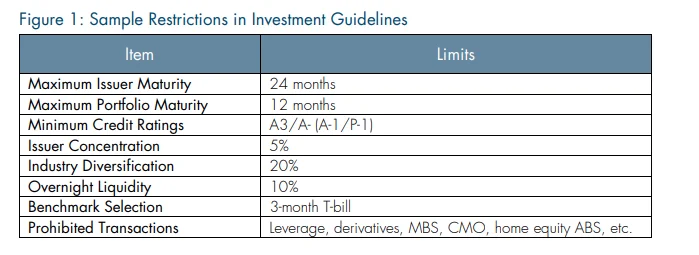

- Tailored Risk Management: Every investor faces unique circumstances that impact income, growth, safety, and liquidity considerations. A one-size-fits-all fund rarely satisfies the preferences of all investors. For example, many institutional investors do not like below-investment grade credits but have little say in a fund’s holdings. Some want to avoid mortgage-backed securities (MBS), asset backed securities (ABS) and other structured investments, but USBFs routinely use them to improve yield potential. In a separately managed account relationship, an investor may set guidelines on key risk control metrics such as maximum maturity, concentration limits, and ratings and liquidity requirements. Another effective risk control mechanism may be a list of prohibited transactions such as the use of leverage, derivatives and/or specific security types.

- Reduced Shared Liquidity Risk: Pooled funds are subject to investor confidence due to mismatched assets and liabilities, meaning that all shares can be withdrawn in a single day, while most assets have fixed terms that must be liquidated to fulfill sell orders, a situation that is prone to runs. This is usually not an issue with government MMFs since the credit quality and liquidity of fund assets (US government securities) are not in question. Shareholders in other pooled funds may follow their instinct and sell at the first whiff of risk. Many such funds are not designed to raise liquidity through selling existing holdings. Rather, managers typically keep a portion of the fund in securities of very short maturities for normal and unexpected redemptions. This shared liquidity cushion is on a first-come-first-serve basis. It Is often called shared liquidity risk. This disadvantage of some pooled funds has a history. The “yield-plus” funds during the financial crisis shuttered after quickly depleting this cushion and failing to sell sub-prime tainted assets to satisfy redemptions. Around the same time, several local government investment pools (LGIPs) froze transactions after running through their liquidity cushion while investor sell orders intensified. In March 2020, several institutional prime MMFs saw runs when the Covid-19 pandemic led investors to doubt the health of the commercial paper market. These past episodes speak to the vulnerability of this type of shared liquidity in pooled funds for cash management. In contrast, separate account strategies are not generally affected by the actions of other investors. SMA investors work with their managers in response to upcoming cash flow changes weeks or months ahead of time. Such information is a valuable tool in liquidity management and investment performance.

- Transparency: Another risk control advantage of separately managed accounts is the level of disclosure. In addition to periodic custody statements and accounting reports, an investor has access to other relevant portfolio information to address issues in a timely fashion. SMAs are accounts held at designated custodian banks in the names of the investors. Transparency is only limited by a bank’s speed of information delivery and the manager’s investment accounting and reporting capabilities. Ultra-short bond funds and other mutual funds, on the other hand, are required by the SEC to file holdings data on a quarterly schedule with up to 60-days in filing lag, making data potentially stale by more than 150 days.4 Some funds may voluntarily disclose holdings on their websites more frequently, but none provide real-time access as one would access their own bank accounts. The lack of transparency may raise anxiety levels when investors want to know their exposure to a particular credit in the headlines. By departing the world of MMF investing, USBF shareholders also lose Rule 2a-7’s enhanced information disclosure protection.

- Lower Portfolio Turnover and Simpler Tax Considerations: Institutional cash managers generally prefer consistent income returns over capital gains. The buy-and-hold approach in MMFs and most cash separately managed accounts seeks to accomplish this objective by minimizing active trading. Ultra-short bond funds, on the other hand, seek total return from both principal and income sources, and are often engaged in active trading. When USBFs buy and sell investments daily to accommodate incoming cash and outgoing redemptions, they incur transaction costs that are shared by all shareholders. The single-owner nature of SMAs makes liquidity-based trading more manageable and less frequent.A cumbersome feature of frequent mutual fund trading is the complex two-level tax recognition. USBF investors, as shareholders, must record tax information on each transaction in and out of the fund. The fund must also distribute substantially all of its gains and losses from its trading activities at the end of the year to all shareholders. Complex tax treatment is one of the reasons institutional investors prefer to own bonds outright over owning bond mutual funds. By contrast, gains or losses in an SMA, if any, are generally associated with specific securities and more easily identified and manageable.

- Income & Capital Gains Management: A related trading advantage for separately managed accounts is the flexibility for investors to retain control in setting book yield targets, income recognition and capital gain/loss management. This is especially valuable for a publicly traded company whose investment income is a meaningful contributor to its bottom line. SMAs allow investors to retain income forecasting capabilities, selectively recognize capital gains and harvest losses for tax purposes. These tools are not available from USBFs.

- Versatile Reporting: In addition to risk and return considerations, separately managed accounts allow investors to receive customized and more comprehensive reporting unavailable from ultra-short bond funds. For investors concerned with specific credit, industry and country exposure, performance measurement, corporate governance, audit oversight and operational efficiency, the number and details of reports are limited only by the investor’s preferences and the manager’s technological capabilities. Reports that detail investment policy compliance related to portfolio activities and current holdings also may be included among these reports. Third party reporting services can provide further assistance to SMAs through treasury workstation integration.

Conclusion

Sensitivity related to uninsured deposits and income preservation in a falling interest rate environment argues for consideration of cash management vehicles beyond bank deposits and MMFs. While USBFs hold promise as potential yield enhancing tools, they may exhibit many of the same issues of prime MMFs with additional drawbacks. A well-researched and well-constructed separately managed account may overcome these drawbacks while helping to deliver benefits comparable to, or better than, USBFs.

Establishing a separate account relationship may take more steps than a mere mouse click on a fund portal, but investments in time and research will serve investors well in times of uncertainty. There is no question that an advisory relationship should be a long-term partnership that requires considerable trust and scrutiny.

Separate account relationships are not without their drawbacks. Less public and comprehensive information is available in the SMA space. The customized nature means there are no uniform performance benchmarks. Risk and return characteristics may not be directly comparable among manager candidates. In light of these considerations, investors may want to start the process with simple and conservative SMA strategies before moving onto more sophisticated account structures.

The six advantages of separately managed account discussed in this whitepaper are intended to stimulate discussions, as every investor’s situation and goals are unique. Shared liquidity funds and separate accounts need not be mutually exclusive. A stratified portfolio with bank deposits, government MMFs, SMAs and other alternative cash vehicles may coexist in an overall cash portfolio.

1Survey: “Organizations’ Cash and Short Term Allocation to Bank Deposits Drop to 47%, Lowest in Four Years,” Association for Financial Professionals, June 13, 2023, www.afponline.org/about/learn-more/press-releases/Details/survey-organizations-cash-and-short-term-allocation-to-bank-deposits-drop-to-47-lowest-in-four-years.Bureau of Labor Statistics, Employment Situation: https://www.bea.gov/news/2023/gross-domestic-product-third-estimate-corporate-profits-revised-estimate-and-gdp

2Refer to U.S. News & World Report classification http://money.usnews.com/funds/mutual-funds/rankings/ultrashort-bond

3Two such examples are Reserve Yield Plus Fund and Charles Schwab YieldPlus Fund. Refer to these archived articles for details: Daisy Maxey, “Reserve Yield Plus Investors in SEC Plea, The Wall Street Journal, September 12, 2009, www.wsj.com/articles/SB125271240924905153; and Floyd Norris, “At Schwab, Unkept Promise to Investors,” The New York Times, January 13, 2011, https://www.nytimes.com/2011/01/14/business/14norris.html

4Refer to www.sec.gov/rule-release/33-8393.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.