Leaving Your Cash on the Sidelines? Think About the Opportunity Costs

Are you moving most of your cash to the sidelines? With new and uncertain risk profiles looming for prime money market funds when SEC-mandated floating net asset values (NAVs), redemption fees and liquidity gates go into effect Oct. 14, many corporate cash managers are defaulting to traditional “safe havens.” More than three quarters of the treasury professionals responding to our 2016 Liquidity Risk Survey reported they are continuing to hold cash in bank deposits, and more than a third said they are moving cash into Treasuries and government money market funds as well.

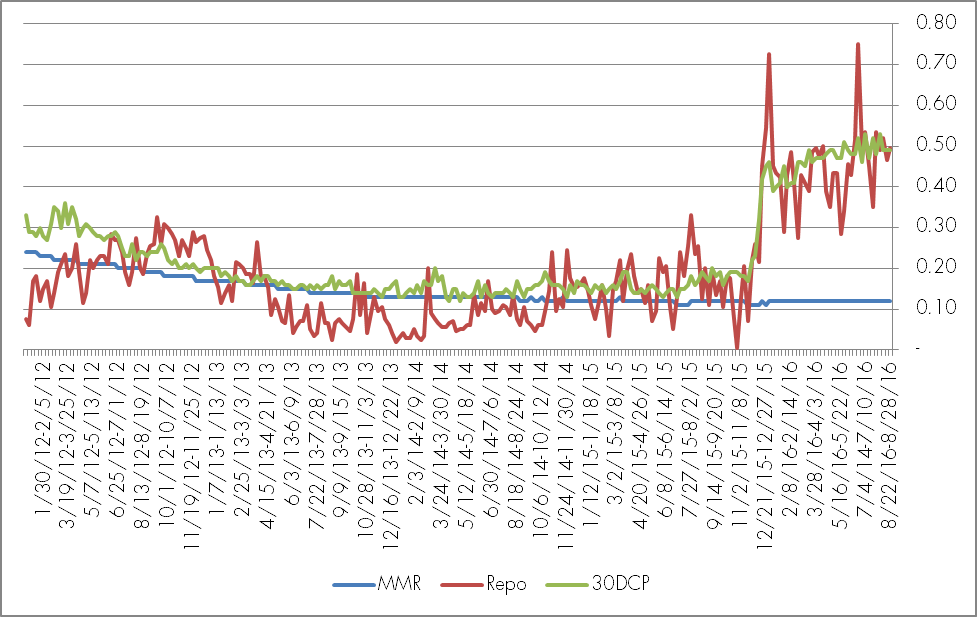

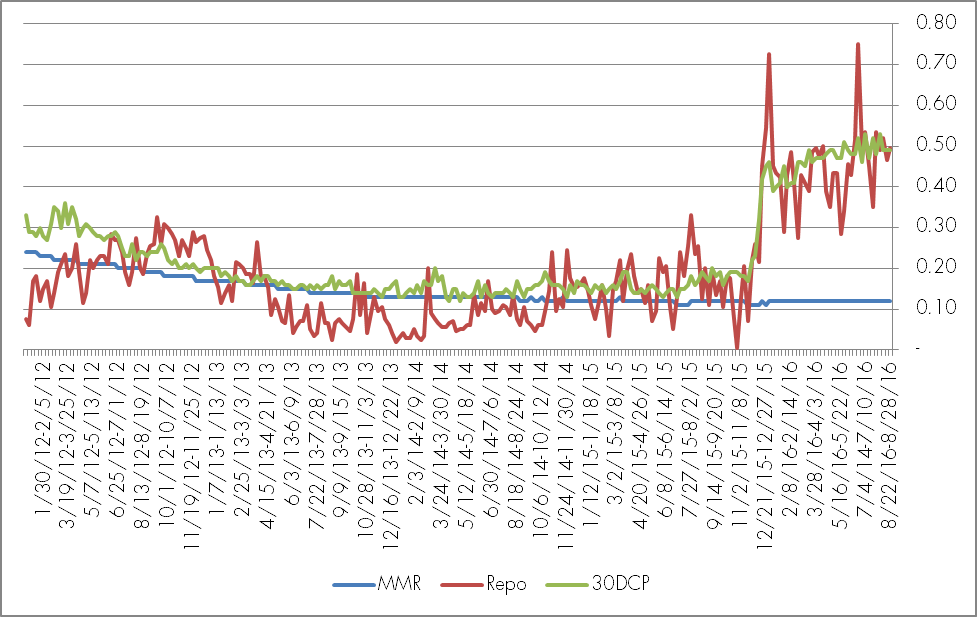

Figure 1: MMDA Rates vs. Overnight Gov’t Repo Rates & 30D A1/P1 CP

Source:

Source:

MMR – FDIC weekly national money market rates for deposits greater than $100,000

Repo – Overnight General Collateral Repo rate backed by government collateral from Bloomberg (Index: USRG1T)

30-Day CP – 30-day non-financial corporate rates from Bloomberg (Index:DCP030D)

Those results aren’t surprising – sweep vehicles are easy defaults – but they also highlight some significant opportunity costs associated with heavy concentrations of cash in low-yielding investments. Our report on this year’s survey shows how rates on 30-day commercial paper and on overnight government-backed repo have more than doubled in 2016 to approximately 0.50% by the end of August, while rates for FDIC deposits stayed flat at well under 0.15%. For cash investors tired of paltry returns, a look at that 35-basis-point differential may be reason enough to consider the opportunity costs and investigate alternatives that may still provide an appropriate balance of safety, liquidity and return.

For more on those results and other insights into how treasury professionals are responding to the new cash management landscape, download our presentation along with this month’s white paper providing detail and commentary on our 2016 survey.

Best Regards,

Ben Campbell

President & CEO

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.