Managing Cash Portfolios at an Inflection Point

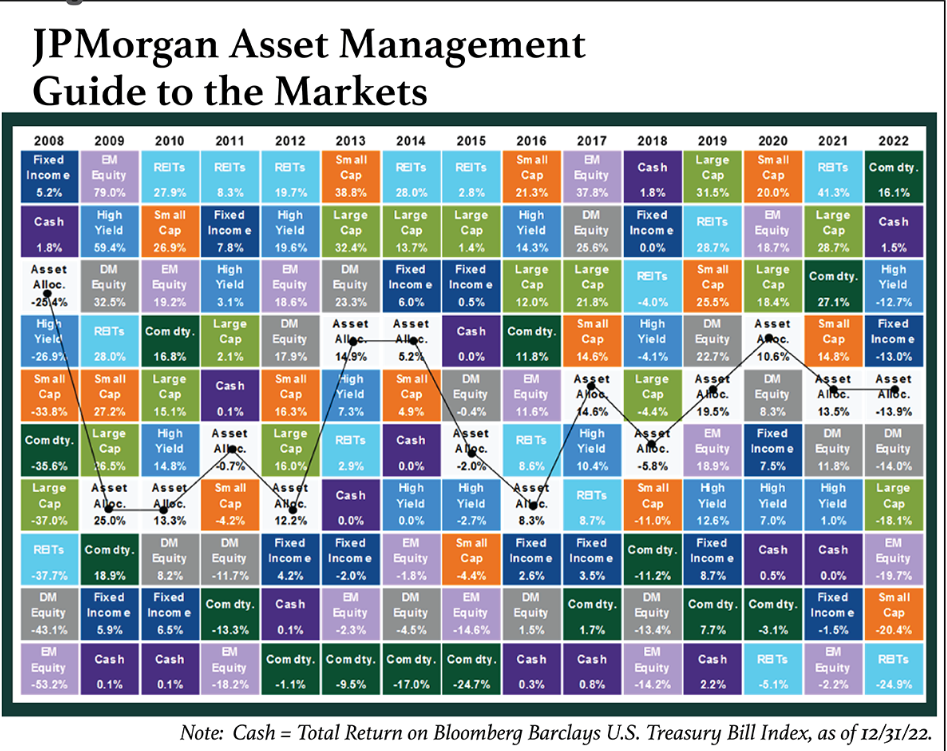

2022 proved to be a defining year for institutional cash investors. An era of low interest rates that lasted more than a decade was flipped on its head, as we entered a new era of interest-rate increases amidst a confluence of economic events. The Federal Reserve tightened policy at a nearly unprecedented speed, raising its target federal funds rate by a cumulative 425 basis points (bps) from March to December. As a result of the higher interest rates, cash investors had a banner year, especially in the context of broader market returns. (See Figure 1, below.)

However, lightning rarely strikes twice. Cash portfolio managers facing new uncertainties as we enter 2023 are confronting a quandary: Should they stay with very short but safe instruments, such as money-market funds or overnight deposits with yields that lag the federal funds rate? Or should they grab higher yields in longer-term securities and risk opportunity costs if future rates exceed current projections?

Their answers will determine what course cash investors set for their portfolios. The Fed has signaled that it’s nearing the end of its tightening campaign, which strengthens the case for adding some duration in portfolios to lock in the benefits of higher rates. But there’s no certainty over exactly when the tightening cycle will end. Although the economic outlook is rapidly deteriorating, inflation remains elevated. And despite some high-profile tech layoffs, the labor market is strong, with unemployment holding at 3.5 percent.

Figure 1:

Guessing Game on a Fed Pivot

Given this backdrop, cash portfolio managers need to refresh their view of the interest-rate outlook. The primary factor, as ever, is the Fed. At its December 2022 meeting, the Fed downshifted its pace of tightening from 75 bps to 50 bps and noted that it was accounting for the lagging effects of monetary policy on its decisions going forward.

Fed Chair Jerome Powell also indicated that the Fed had shifted its focus away from the pace of rate hikes toward the level of the terminal rate. The majority of Federal Open Market Committee (FOMC) participants put the peak rate at 5.0 percent to 5.25 percent for year-end 2023, equivalent to another 75 bps in tightening. Futures markets are projecting that tightening will end by the second quarter of 2023, following an additional 50 bps to 75 bps of hikes.

Those predictions suggest that a pause is imminent. With a weakening economy in 2023, investors should be prepared for rates to plateau. As of January 20, consensus projections for GDP growth were just 0.5 percent, according to Bloomberg’s composite private-sector forecast, and Bloomberg’s 12-Month Recession Probability Indicator (a composite of private-sector forecasts) put the probability of recession at 65 percent, as of the end of last year. That’s a level reached only during the 2008 financial crisis and the Covid-19 pandemic.

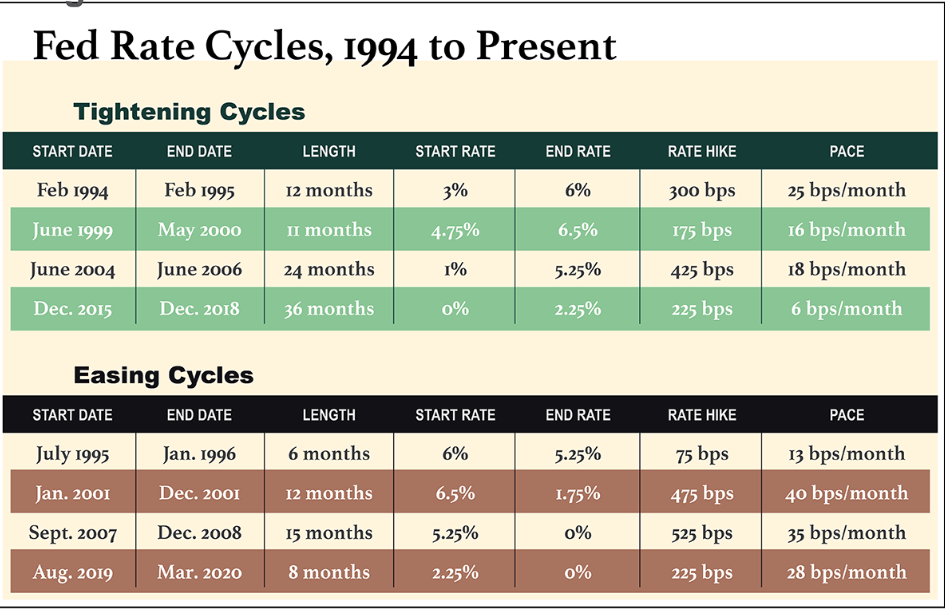

The market is already pricing rate cuts into its baseline scenario. But, given the Fed’s own history, the market may be underestimating the possible depth of those cuts. Chair Powell has set the bar high for pursuing cuts, but if the Fed begins cutting rates, there’s no telling how far or how quickly they could fall. (See Figure 2.)

Figure 2:

Source: Federal Reserve Board.

Conversely, several factors could come between the Fed and a pivot in 2023. Inflation remains unacceptably high, with the headline and core Consumer Price Indices (CPIs) currently at 6.5 percent and 5.7 percent, respectively, year-over-year. Positive developments over the final three months of 2022 suggest that inflation has finally peaked, in large part due to energy-price declines. However, considering its starting point, a sustained period of gradual reductions in the inflation rate will be necessary for it to reach the Fed’s target of 2 percent.

The labor market poses another problem. Labor shortages are abundant throughout the economy, as evidenced by a near-record-high number of job openings per unemployed person. This has resulted in rising wages, as firms have to compete for workers and accommodate requests for increased compensation to reflect the rising cost of living. Simultaneously, productivity growth has lagged, pushing up unit labor costs (essentially, the cost of wages plus benefits per unit of output). If this trend does not abate, it could force the Fed into additional tightening to prevent labor cost pressures from de-anchoring inflation expectations.

Ultimately, it pays to remember that no one holds a crystal ball. This is particularly true of the Fed, which has continually miscalculated interest rates’ trajectory since the 2008 financial crisis. Back in 2015, the Fed estimated that it would increase interest rates from their 0 percent floor, in predictable 25 bps increments, such that they would reach 1.25 percent by the end of 2016. It turned out that this scenario was wildly optimistic, as the Fed was forced to keep rates in the range of 0 percent to 0.25 percent until December 2016. Investors who stayed short, on the expectation that rates were set to rise imminently, faced years of disappointment.

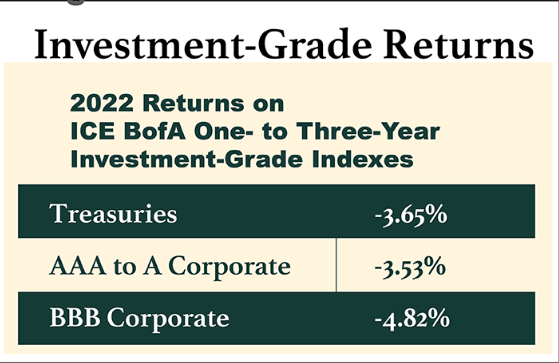

In the current cycle, the Fed has repeatedly underestimated the pace of rate hikes. In December 2021, FOMC officials projected that the federal funds rate would end 2022 at 0.75 percent to 1.00 percent. Many investors who failed to learn the lesson of 2015 and 2016—that Fed predictions are just that: predictions—extended the duration of their portfolios and ended up underwater, with significant unrealized losses. The impact of those losses is reflected in the ICE BofA One- to Three-Year Treasury Index, which posted a loss of 3.65 percent in 2022, the index’s largest loss since its creation in 1975 and only its second year ever with a negative annual return.

Institutional Cash Investment Portfolio Strategies

Given these uncertainties, what’s the best strategy for managing a corporate cash portfolio in this market cycle?

Cash equivalents. On the back of rising interest rates and the poor performance of longer-duration bonds, cash investors are allocating a larger proportion of their funds to very-short-maturity instruments. This helps explain why money-fund assets posted a recovery following a decline at the start of 2022. From the period of December 2021 to May 2022, money-fund assets declined by $197 billion, to $5.02 trillion. Then they reversed course to reach a near-record high of $5.18 trillion by November 2022. By contrast, bank deposits have started to decline following the initiation of quantitative tightening, but they remain approximately 33 percent above pre-pandemic levels, on the back of inflows from both households and businesses.

A downside of short-maturity products is that they essentially constitute a one-way bet on interest rates. Their investors will be successful only if the Fed ends up tightening more than expected. Should the Fed be forced to cut rates in response to a “hard landing,” investors in these securities will face the very real possibility of earning little to nothing on their cash investments.

An additional downside is that the short-term options for investors tend to earn less than the federal funds rate—or, more appropriately, comparable overnight repurchase (repo) rates.

Government money-market funds are constrained, by their liquidity requirements, from earning much more than the Fed’s reverse-repo rate. Investors that use these funds as vehicles for earning returns are thus earning only the reverse repo rate minus the fee that the fund charges. Investors that buy Treasury bills directly are not necessarily better off, though. They must deal with a crowded marketplace, particularly now that issuance is declining off the back of deficit reduction.

And corporate investors who keep funds in bank deposits tend to perform the worst, since banks have sole discretion over how much they pay out to depositors. Data on institutional deposit rates is opaque, but the national money-market deposit rate languished at 0.44 percent as of January 17, 2023, compared with a federal funds target range of 4.25 percent to 4.50 percent.

Corporate debt. An alternative strategy to consider is buying corporate bonds with laddered maturities further out on the yield curve. The maturities might range from overnight to, say, 15 or 18 months, at which point rates begin to fall off steeply.

This strategy doesn’t require investors to bet on the direction of interest rates, and it provides benefits in either direction. If the Fed raises rates more than the market anticipates, investors will likely benefit from their allocation in cash and short maturities. Conversely, if the economy crashes into recession, investors will have locked in some higher interest rates, helping to protect themselves from inevitable rate cuts.

An additional consideration is whether to add corporate credit to portfolios. Corporate credit quality has been exceptionally strong this cycle, leading to record-low default rates. However, credit ratings are expected to erode somewhat as economic growth weakens and the impact of higher interest rates flows through to funding costs. Bloomberg’s ratings tracker indicates that Moody’s issued nearly twice as many ratings downgrades as upgrades in the fourth quarter of 2022. Concurrently, credit spreads held steady, suggesting the market was ahead of this news.

For institutional investors that can absorb market-value fluctuations, the extra yield provided by corporate investments may cushion some of the potential mark-to-market losses. However, the returns will be dependent on credit quality. Lower-quality credits will typically offer more yield, but will perform worse if rates rise or spreads widen further. ICE’s BofA One- to Three-Year AAA-to-A U.S. Corporate Index outperformed the commensurate Treasuries index by 12 bps in 2022. By comparison, the BBB index (the lowest rung of investment-grade) underperformed Treasuries by 117 bps. (See Figure 3.)

Figure 3:

Source: Bloomberg.

Prime funds. Prime money-market funds offer cash investors an alternative path to corporate exposure. These vehicles were popular in previous rising-rate cycles, as they quickly passed on higher returns and provided yield potential with short-term credit instruments. Investors may be tempted to look toward them once again, as their spread over institutional government funds was 38 bps at the end of November.

However, investors should understand the risks associated with prime funds. The liquidity squeeze in March 2020 exposed their structural vulnerability, due to “fees and gates” that encouraged a run on the funds. The U.S. Securities and Exchange Commission (SEC) has attempted to address this structural issue via new guidance, but that comes with its own set of issues.

Notably, the new guidance includes a “swing price” factor, an esoteric rule that would, effectively, penalize investors who pull their money out during a period when the fund is experiencing losses. Investors would have time to adapt, as actual implementation would not commence for 12 months following finalization of the rule. But it would fundamentally change the risk profile of prime funds—again.

Portfolio Takeaways

Many corporate cash investors who delivered strong results in 2022 are under the gun to continue their success in 2023. With a higher level of uncertainty, especially over the timing of a possible Fed pivot from its current tightening cycle, these investors will need to keep the following points in mind:

1. Prognostication about interest rates is inherently risky, particularly in the current environment. From a risk management perspective, it makes sense for investors to be prepared for an environment of either rising or falling interest rates.

2. A laddered securities portfolio may allow investors to lock in some of the benefits of higher rates, while also accessing upside benefits if rates rise more than expected.

3. Corporate securities may offer additional returns via their spread over a Treasuries-only strategy. However, credit quality matters in a rising-rate environment.

4. Prime funds offer a path to corporate exposure but come with their own set of ever-changing risks.

Those who keep a close eye on the Federal Reserve, and stand ready to adjust their investment mix as the course of interest rates becomes clearer, will better position their portfolios for continued success in 2023.

Matthew Paniati

Senior Analyst, Capital Advisors Group