2020 Vision – Watch the Fed, Repos and ESG Investing

Abstract

We identify three themes to watch for cash investors each year. For 2020, we comment on the Fed’s neutral stance, the continued non-solution for repo market liquidity, and the popularity of ESG (environmental, social and governance) investing.

Introduction

At the start of each year, we typically name three broad themes that may impact the short-term debt markets. Our 2019 picks were a) the Fed and a flattening yield curve, b) trade wars and a global slowdown, and c) Brexit and other uncertainties.

The three themes followed the market for most of the year. To tackle growth concerns, the lack of inflation, and the negative effect of tariffs, the Federal Reserve cut the fed funds rate three times (0.75%) to revert the yield curve back to a positive shape. The path to a US-China trade pact experienced many twists and turns without a clear destination. Brexit dominated the air waves, but Great Britain still ended the year as part of the European Union.

Continuing our tradition of looking for forests rather than trees, we narrowed our 2020 candidates to a) the Fed’s pause on rates, b) solutions to repo market liquidity, and c) ESG investing gaining popularity. With some luck, 2020 may turn out to be an unremarkable year, which is a good thing for risk averse cash investors.

1. The Fed Intends to Stay Neutral, but Will it Succeed?

The Fed lowered the fed funds rate to a range of 1.50-1.75% in three consecutive cuts from July through October. In the minutes of the October FOMC meeting, Fed officials considered the level as “well calibrated” and would “remain so as long as incoming information about the economy did not result in a material reassessment of the economic outlook.” The December meeting reaffirmed this stance. In the post-meeting conference, Fed Chair Jerome Powell said that the Committee will respond to developments that warrant “a material reassessment” of the current outlook1.

The Cuts were Pre-emptive: Recall that the Fed entered 2019 with a tightening bias on rates. The central bank initially avoided discussing the economic impact of trade wars with our international partners. At the time, the federal government was shut down. Shortly after, President Trump was closing the southern border with Mexico. His Summit with China’s Xi Jinping did not produce a trade treaty. British Prime Minister Theresa May stepped down after failing to take the UK out of the EU. Economic indicators from Europe to Asia to the Americas were flashing yellow. For Chair Powell and his colleagues, it was a good time to take out an insurance policy by making a “mid-cycle adjustment to policy” while inflation risk was nonexistent.

The rate cuts were not without controversary. Some believed the earlier increases were either too soon or too fast when wage growth was tepid and core inflation failed to reach 2.0%. Others thought the Fed ought to take the policy rate to neutral in order to combat the next downturn. There were dissenters in both directions during this period of mid-cycle adjustment. By the October FOMC, it appeared the Committee was unanimous in believing the economy was strong enough without further monetary policy assistance.

Recession Concerns Have Subsided: During the intervening months, fundamental economic needles have hardly moved. Monthly payrolls remain strong, with the unemployment rate at a multi-year low of 3.5%. Wage growth remains subdued at around 3%, while the core PCE inflation rate hovered around 1.5-2.0%. Manufacturing continues to face headwinds, but service-sector ISM and industrial production remain strong. Despite the trade war, China’s winter in manufacturing also shows signs of a thaw, with its manufacturing index climbing back to expansionary readings in recent months. Easier monetary policies in developed economies also seem to be working in preventing the global recession many had feared.

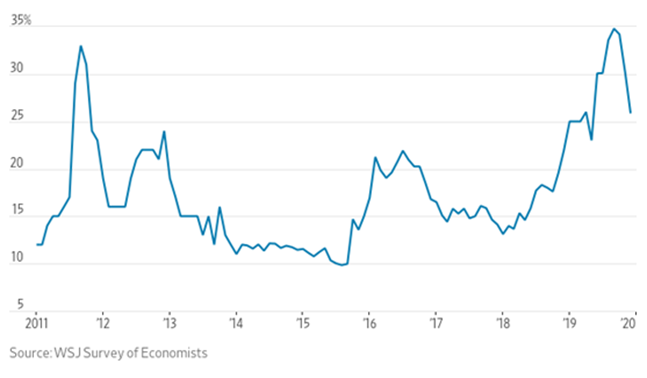

After the rate cuts, the inversion in the yield curve, a leading recession indicator, has dissipated. The yield spread between the 10-year and 2-year Treasury notes is now at about 30 basis points, the steepest it has been since November 2018. The median economists’ forecast of the US entering a recession within a year receded from 35% last summer to around 25% today.

Figure 1: Yield Spread Between 2 and 10-year Treasury Notes

Source: Bloomberg.

Figure 2: Probability of the US Economy Being in a Recession within the next 12 Months

Source: WSJ Survey of Economics

The Fed Hopes to Stand Pat, but the Market Expects a Cut in 2020: The Fed has good reasons to stand aside while the three cuts work their way through the economy. The passing of the US-Mexico-Canada trade agreement, the phase one deal with China, and an expected orderly Brexit after the UK election each removed growth uncertainties in 2020. The Fed has the additional incentive of rising above politics by staying the course in a presidential election year. We think the bar for economic developments that warrant the Fed’s “material reassessment” will be quite high this year.

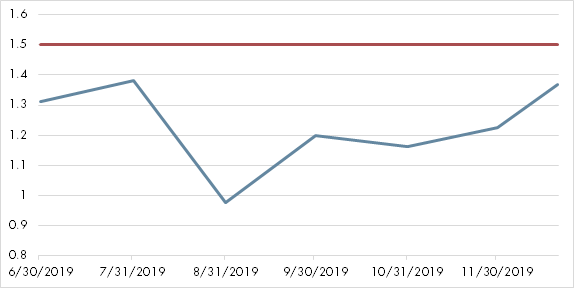

The futures market, however, continues to bet that the Fed has one more cut to go. The fed funds rate expected at the end of 2020 was as low as 0.975% in August, before trending back to 1.37% in December, implying about a 50/50 chance of it going down to 1.25%. While we can think of several scenarios that will force the Fed’s hand, the data on the ground seem to indicate the current rate environment will be stable for the next 12 months. This would be welcome news to institutional cash investors, as the fear of rates going back to zero or even negative certainly has subsided.

Figure 3: Futures-Implied Fed Funds Rate at 12/31/2020

Source: Bloomberg’s WIRP screen as of December 20, 2019.

2. When and How will the Repo Market Quiet Down for Good?

Last September, a sleepy part of the financial markets attracted much attention from the wider investor community. Interest rates on overnight repurchase agreements known as repos, usually tracking the fed funds rate at 2%, spiked as high as 10%. Never mind that these are overnight loans secured by US government securities. There were not enough investors to take advantage of the high rates. The Federal Reserve quickly put a stop to this market anomaly but pumping cash into the repo market through open market operations.

The two-day repo ruckus was widely understood to be caused by a temporary blockage in the flow of liquidity to the financial system by a number of things happening at the same time – a large debt offering by the US Treasury coupled with corporate tax payments and cash moving out of deposits by large banks. But this was not the whole story, as those events came and went but the Fed is still pumping liquidity day in and day out, and is expected to do so until some permanent solutions are in place to get liquidity back to normal.

The Fed So Far Has Stuck to Temporary Fixes: Since the Fed’s initial injection of liquidity in September, it has continued to do so by conducting daily and term repos through temporary open market operations. It increased daily limits progressively and added term repos along the way to manage quarter-ends and the year-end. Total temporary liquidity over the year-end was nearly half a trillion dollars, compared to the entire tri-party repo market of $2.1 trillion. Although multiple options were discussed as potential long-term liquidity solutions, Fed officials indicated that they will continue with the temporary solution for the foreseeable future.

Why This is An Issue for Cash Investors: We should first clarify that most institutional cash investors were not at risk of losing their investment principal nor access to liquidity. The instruments in question are backed by the highest quality collateral in the market. Some corporate cash investors use repos as liquidity tools, but most are indirectly exposed to the market through government and prime money market funds, which typically use government repos as liquidity instruments. While the theoretical probability exists for a money market fund to receive government securities instead of cash back when liquidity dries, this is very unlikely other than in isolated cases and is not the reason we are interested in this subject.

Market observers generally agree today that the perceived ample liquidity in the capital markets is less than meets the eye. Large banks also complain that recent financial regulations prevent them from redeploying those reserves to support the repo market. The Fed began to taper off its enormous balance sheet in October 2017 and was scheduled to end the taper last September. In retrospect, the reduction in reserves from $2.8 trillion to $1.4 trillion over two years may have been overdone. Non-bank affiliated broker-dealers are finding repo instruments less reliable to fund their securities portfolios or to serve non-corporate lending clients.

The recent money market fund reform resulted in cash managers’ preference for government money market funds, which tend to rely more heavily on government repos than prime funds that have more investments in commercial paper instruments and bank deposits. The calendar effect of corporations making payments on certain days is now having a greater effect on their repo counterparties. A recent rule change to allow money market funds to participate in the “sponsored repo” pool reserved for broker-dealers makes this effect more direct.

These so-called “technical” aspects of the repo market are important for cash investors, even though they may not face immediate risk of principal and liquidity. Some of these causes do not have quick fixes, which is the reason the Fed prefers to continue with its temporary fix. It should serve as a stern reminder that the repo market is not fully well until the Fed gets out of the business of propping daily liquidity.

The Fed’s Plan and Timing of Implementation: For months before the September repo tumult, Fed officials were observing the connection between reserves and Treasury securities, both of which are high-quality liquid assets (HQLA) for regulatory purposes. The idea of a Standing Repo Facility (SRF) was first noted in a St. Louis Fed blog on March 6, 20192. The idea was to reduce the need for a very large Fed balance sheet if the banks can readily convert their Treasury holdings to reserves with the facility. At other times, they can satisfy HQLA requirements with Treasury securities and earn higher yield than reserves. Once operational, the SRF can replace temporary open market operations and be more effective, as the counterparties will include large and smaller banks as opposed to primary broker-dealers.

SFR appeared in subsequent FOMC minutes, but the central bank has not decided when it will become operational. At the December FOMC press conference, Chair Powell said the officials “will take time to evaluate and create the parameters” before it can be put in place as the Committee was focused on year-end liquidity3. He commented further that as the Fed continues to purchase Treasury Bills, reserve balance will move up so that the need for overnight and term repos will drop at certain point.

It appears that the SRF will not be here any time soon, nor are relaxed regulatory rules a serious option. Rather, the Fed will focus on growing the reserves through incremental purchases of Treasury bills as it announced at the October meeting. This would have the cumulative effect of adding about $300 billion to the balance sheet by the end of the second quarter. Whether that’s enough to relieve the liquidity shortage is yet to be determined.

We think the timing of resolving repo market liquidity is contingent upon the Fed’s implementation of the SRF. We don’t think the current pace of Treasury Bill purchases will replenish reserves soon enough to solve the problem unless the Fed quickens its pace, which is unlikely barring recessionary worries. This means the Fed will continue to rely on temporary measures and the financial market participants remain uneasy with the arrangement.

3. ESG Cash Investing, Facts or Fad?

The mention of environmental, social and governance (ESG) investing in the liquidity management space went from nonexistence to a trickle then a stream in the span of four to five years. Responsible investing was in the domain of equity investors for decades, maybe centuries, to promote a social good in addition to financial profits. A 2004 UN-sponsored ESG study calling for investment managers to align with its Principles for Responsible Investment appeared to propel the ESG campaign to become a mainstream mandate for stock and bond portfolios4. It was a matter of time before cash investors took interest in the subject. In response, at least half a dozen institutional money market funds were introduced in the last two years in the US to cater to ESG-minded investors.

The whirlwind coverage of the subject at investor conferences and in financial media is met with equally strong cynicism in parts of the cash investment community – is this a fad? Can cash investments really make a difference towards a greener earth and more social justice? Love it or loathe it, we think the trend towards ESG investing is just getting started, so get ready. Here are a few reasons why the trend will continue.

ESG is Compatible with Credit Conservativism: The hypes and the buzzword notwithstanding, ESG principles are highly compatible with the risk averse credit culture of most liquidity investors. There is growing recognition that ESG issues represent hidden credit risks with material financial impact to bond investors. Veteran investors can attest to the fact that many industry titans and bellwether credit investments (Wells Fargo and Boeing come to mind as examples) fell on hard times because of neglect in this area. Incorporating ESG principles in the credit evaluation process is not only good for the environment and society, it’s good for business.

Investors are Leading the Push: Unlike product innovations characterized by investment managers advocating for acceptance, institutional investors are generally in the lead imploring their managers to provide ESG solutions. More retirement accounts, endowment foundations and public companies are proactive in expanding mandates to serve customers, employees and other stakeholders of the millennial generation. This generational shift will outlast recent relaxation or reversal in certain ESG regulations.

Regulators are Crafting Rules: While regulatory guidance appears to be moving slowly in the US, European policymakers have been spearheading ESG initiatives with the European Commission’s Sustainable Finance Package of Measures to guide marketable instruments (MiFID) and insurance products. European rules on the equivalents to the US’s mutual funds, and hedge funds are also being revised to embed sustainability risk considerations in the investment decision-making process. ESG disclosure rules also are in the works. Since large investors and asset managers often straddle both sides of the Atlantic Ocean, we should expect more ESG considerations in US portfolios5.

Dig Deeper Underneath an ESG Label: It is a giant understatement to say that more work is needed towards ESG transparency in today’s investment world. This is part of the reason for many ESG skeptics today. The lack of standardization and verification of disclosure, measurement and criteria create a myriad of problems to discern and compare various offerings. It was reported that irregularities in certain ESG funds have drawn SEC scrutiny6. The unique challenge of short-term obligations by financial issuers presents the additional issues of relevance and concentration. It may be one thing to pick a manager to run an ESG mandate in order to check a box, but it is an entirely different matter to ensure that the mandate serves the people who entrusted the funds to be managed. ESG investing is not a fad, but the path to maturity and credibility may be a long and winding one.

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

1Read the transcript of Chair Jowell’s December 11, 2019 press conference here: https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20191211.pdf

2On the Economy Blog, Why the Fed Should Create a Standing Repo Facility, Federal Reserve Bank of St. Louis, March 6, 2019. https://www.stlouisfed.org/on-the-economy/2019/march/why-fed-create-standing-repo-facility

3Read the transcript of Chair Powell’s Press Conference dated December 11, 2019 here https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20191211.pdf

4Please refer to our whitepaper Demystifying ESG Investing – Considerations for Institutional Investors in the June 2019 issue of the Capital Advisors newsletter. https://www.capitaladvisors.com/research/demystifying-esg-investing/

5Andy Pettit and Aron Szapiro, Regulating the Growth of ESG Investing, Morningstar Blog, June 03, 2019, https://www.morningstar.com/blog/2019/06/03/esg-regulation.html

6Juliet Chung and Dave Michaels, Markets: ESG Funds Drew SEC Scrutiny, The Wall Street Journal, Updated December 16, 2019, https://www.wsj.com/articles/esg-funds-draw-sec-scrutiny-11576492201?mod=djemwhatsnews

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.