WHEN, WHY and HOW MUCH: Common Misconceptions in Early-Stage Debt Financing

Abstract

Having advised hundreds of companies on billions of dollars of debt transactions over the past 16 years, Capital Advisors Group has encountered many common misunderstandings about early-stage debt financing. To address possible misperceptions at the outset, we always ask would-be borrowers three important questions: When are you considering pursuing debt financing? Why you are you considering debt as a financing option? And how much are you hoping to borrow to meet your goals? This paper aims to correct misconceptions borrowers often have about each of those questions and to shed some light on how debt financing can be used strategically to benefit a company’s early stage growth.

I. WHEN?

“When” is very likely the most difficult question for companies to answer. It cannot be overstated that debt financing scenarios are specific to individual companies. In each case, cash on the balance sheet, recurring revenue metrics, positive year-over-year growth, timing of development milestones, IPOs, commercial launches, data readouts, and much more must be taken into account. As an advisor in early-stage debt financing transactions, Capital Advisors Group’s initial step is to help companies understand if the “when” can be “now.” Oftentimes, companies are advised to avoid debt financing based on factors such as remaining cash and cash life, a lack of assets in the pipeline (especially for healthcare companies), high customer churn, or lagging growth. However, debt financing may be entirely appropriate when those companies have top-tier investors, sufficient cash and cash life, a robust pipeline of products, low customer churn, predictable revenues, high growth, and high margins, or a combination of those elements. (Note that we define “early stage” not by how long the company has been in business, but by its status as an entity that has not yet, or only recently, began generating revenue or reached a net cash positive position.)

Misconceptions About When to Seek Debt Financing

Many companies (most often in life sciences) pursue debt too early, in many cases soon after raising their Series A round of venture capital. Successful use of debt financing requires a real sense of how it may support growth and help the company reach a milestone it may not otherwise achieve with the equity it has raised. But oftentimes, after a large Series A raise from a well-known investor or investor syndicate, companies are flooded with offers from banks to open a line of credit as “insurance.” Many take a line of credit before they even know if they need it or how it may be used. Such lines may or may not end up getting drawn. But when they do, the debt can create administrative headaches as these companies raise larger equity rounds in the future but are stuck with keeping cash deposited in the bank as collateral for outstanding balances on the loans.

Conversely, many times companies wait too long to decide debt financing may be a good option. Management often feels more confident than it should about its prospects for raising debt on short notice. In fact, for cash-burning companies, there should be at least 12 months of cash remaining for the best loan terms. Any cash life shorter than 12 months, without a plan for a near-term equity raise or a path to profitability, will often dramatically diminish the possibility of raising debt financing. Of course, the requirement for 12 months of cash is relaxed when revenue or profitability are factored in to the credit analysis.

II. WHY?

Why should an early-stage company borrow in the first place? The primary reasoning behind debt financing is that it can help avoid the dilution that is typically associated with equity financing. Assuming the company is able to repay the debt, dilution to founders and management is often comparatively miniscule or, sometimes, nonexistent. But while avoiding dilution may be a primary driver for debt, there are many additional situations where it may be appropriate:

Financing Pipeline Activity (Biotech-Pharma exclusive)

- Fund early phase pipeline expansion

- Fund trials (Phase 1, 2, 3)

- Extend company operations to data readout

Equipment Leases and Loans

- Provide flexibility on lien coverage

- Allow junior and senior debt

- Financial flexibility in acquiring equipment

Refinancing

- Ease cash-flow concerns

- Extend Interest-only period

- Enable refinancing of high-yield notes

Growth Capital

- Sales and marketing expansion

- Territory expansion

- Expanded manufacturing capacity

- Potential low-cost bridge to profitability

- Cash runway extension (usually as a substitute for dilutive equity)

- Research and development (non-Life-Sciences)

General Financing

- Hedge downside risk leading up to an IPO

- Lower dilution of concurrent equity round

- Lower equity/debt ratio

- Provide final financing before commercial launch

Capital Advisors Group has advised on transactions that fit all the scenarios above and then some. It is our goal to help companies pursue debt financing strategically and to their greatest benefit. One of the best uses of debt capital, in our experience, is outlined in the brief case study below. It resulted in the client successfully achieving a milestone that ultimately lead to acquisition.

Case Study: Unique Use of Debt Funds

Capital Advisors Group (CAG), was engaged by a clinical-stage biotech firm with a strong investor syndicate that was seeking debt financing to supplement a recent equity raise and to provide a bridge through a projected potential acquisition date. The biotech firm was engaged in an exclusive R&D collaboration with a large pharmaceutical company that had an option to acquire the firm at the end of the collaboration period in 2018. The biotech firm had lined up a single near-term equity financing of $11 million. And it was considering raising debt capital to provide enough additional cash to help support its operations through the potential acquisition date. CAG set out to help determine the appropriate capital structure (including debt and necessary future equity financings) that would support the company out to, and slightly beyond, this important inflection point outlined in the R&D collaboration agreement.

In early May 2017, CAG issued its request for proposal to multiple lenders, including venture debt providers and banks that would be suitable for an early-stage biotech deal. Feedback varied widely on the transaction, demonstrating the benefit of running a broad process involving multiple potential lenders. There were some tepid responses due to the relatively early stage of the company. But there were also some more aggressive proposals based on several factors, including the strong investor syndicate. With each set of proposals, CAG developed a comparative analysis for the company that evaluated the proposals against each other. Eventually, CAG and the company narrowed down the proposals to a list of three lenders. The three proposals met the client’s expectations while providing room for CAG to negotiate better terms to ultimately win the company’s business. After one of the lenders was unable to meet the strongest terms presented to the company, CAG narrowed down the list to two finalists. CAG presented the company’s CEO and CFO with two scenarios that would determine the costs of the proposals. Scenario one provided a breakdown based on the biotech firm being acquired and paying off the loan before the maturity date. Scenario two provided a breakdown based on the company not being acquired and taking the loan to term. After reviewing and negotiating multiple proposals, CAG helped negotiate a winning bid within four weeks of initiating the process. The winning bid was priced competitively to market terms, with a flexible deal structure that provided enough capital for the biotech firm to remain funded substantially beyond the target date into 2019.

CAG’s Debt Database Tracks Prevailing Market Terms

The final loan terms met or improved upon every characteristic of the prevailing market terms CAG tracks in its debt database. Compared to other deals in the database:

Funding contingencies for each tranche were negotiated to be set at milestones that met current standards and were suitable to both the lender and the company.

- There was low cost of capital with flexibility on draw periods.

- There was low-to-no final fee.

- Facility fee and deposit requirements were very reasonable.

- There were low-to-no prepayment penalties

- There were no financial covenants

- A low success fee, versus an option for warrant coverage, was negotiated.

The flexible deal structure allowed the company to turn its focus to executing on its programs in the pipeline with the confidence it would be funded through a major milestone and potential exit in 2018. The company ultimately did achieve its objectives and was acquired per the plan.

Misconceptions About Why to Seek Debt Financing

When a company wants to “supplement the balance sheet” with debt financing, it always raises a red flag. That’s because it indicates the company may not have a goal in mind for use of the proceeds. Too often, companies find that after an interest-only period expires, significant cash flow constraints await when loans begin to amortize. If a company can’t reach a critical milestone and increase its valuation for a subsequent financing, IPO, acquisition or other significant event, debt financing is likely not appropriate.

III. HOW MUCH?

The answer to the question of how much debt a company should seek is sometimes less evident than one might think. The best answer (or question) to “how much can I get” is “how much do you need?” Any type of financing, be it equity or debt, is a means to an end—and more is not always better. There is an easy benchmark for cash-burning companies with no prospects for near-term revenue (i.e. life sciences and some medical devices). If there is a strong institutional investor or investor syndicate and, as previously noted, at least a year of cash, the company may be able to borrow up to 50% of the current equity on hand. This is a very general benchmark, and circumstances can vary widely. However, unless seeking maximum leverage is absolutely necessary, a better approach may be to consider how cash needs and potential cash runway extension may overlap with critical milestones. From there, one may back into a more comfortably sized financing that will best serve the company’s goals. Consider the example below:

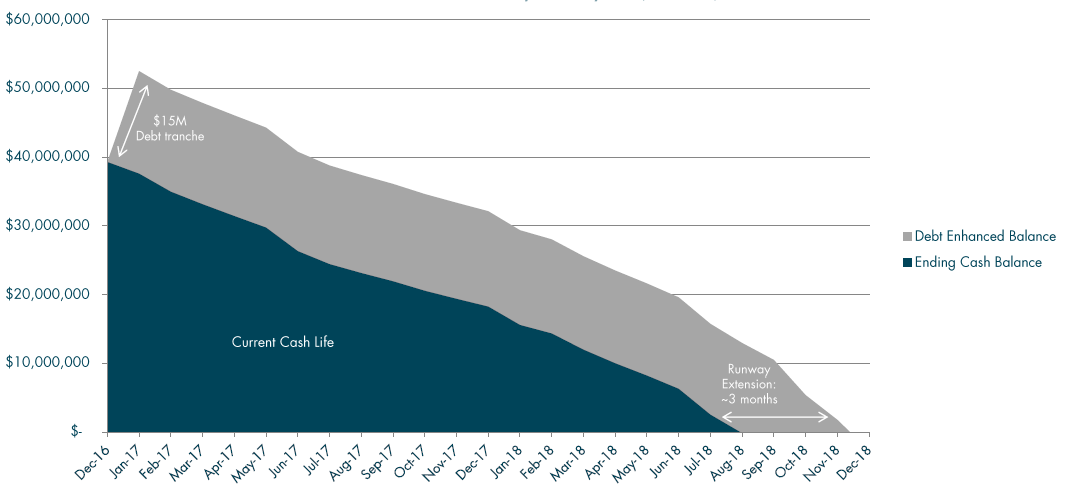

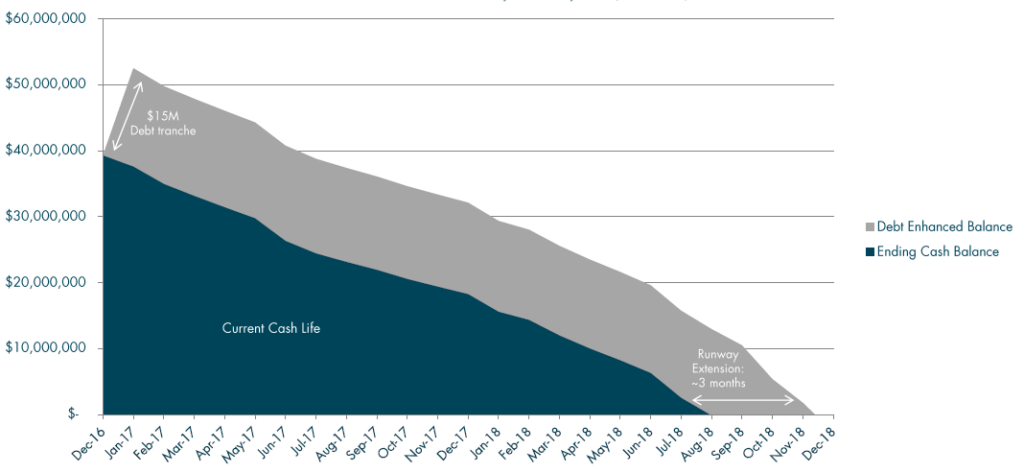

Example: Cash Runway

Source: Capital Advisors Group, Inc.

In this example, the company didn’t need maximum leverage to achieve its goals. It took only as much debt as it needed to create a capital cushion to carry itself through to a successful IPO.

Equity raises and available cash are certainly not the only factors to be considered when it comes to how much a company may be able to raise in an early-stage debt financing scenario. Investors, revenue, historical and projected growth, margins, customer retention metrics and many more factors can come into play as companies consider a debt round. In many cases, right-sizing a deal can be a bit of an art and a science. There are numerous providers of debt capital who seek deals in particular sectors, who are able to deploy different amounts of capital per deal, and who may have the ability to provide unique structures. Therefore, it is incumbent upon the company to seek the appropriate size deal at the right time under the right circumstances. And it is then crucial to seek the appropriate lending partner.

Misconceptions About How Much Debt to Seek

As has been addressed, maximum leverage is not always the answer. More is not always better. There is also a perception that debt provides more flexibility to grow the business than equity, where equity investors may seek more control in decision-making and daily activities. However, if not used properly, debt facilities can often restrict a company’s cash flow and prevent the management team from pursuing alternative financing options.

Once a company draws down on the facility, it is often obligated to immediately commence repayments (typically monthly), thus reducing future cash flow. These payments don’t include additional upfront expenses, which can include a facility fee, legal fees, filing costs, and out-of-pocket fees associated with the transaction. A burdensome repayment schedule can hinder the company’s ability to keep up with operational expenses or to invest in projects that could grow the business going forward.

Conclusion

Misconceptions abound when it comes to the early-stage debt financing market. However, resources to help avoid mistakes and guide you through the process are available. Advisors like Capital Advisors Group can shed light on when, why and how much debt to take on. They should also provide market assessments of what may or may not be available in debt round. And an advisor can act as a conduit to the most appropriate sources of capital, depending on the company’s sector, deal structure and size.

Companies pursuing financing on their own should have access to a network of appropriate sources of capital. They should avoid the common misconceptions and go to market with reasonable financing requests. We recommend identifying no less than six lenders that might be suitable for your deal. You should also understand the typical structures of deals that lenders may be able to offer. For instance, structures available from banks versus non-bank funds can have dramatic differences in structure. Interview them, get to know them, and research their reputations in the market. It will be a multi-year relationship, after all, and you want to enter into it with a good partner. Then, solicit term sheets and negotiate the deals on a comparative basis. Such a process takes much more time than relying on a single source and accepting offered terms. But it should result in a much more favorable financing and long-term outcome for the company.

DOWNLOAD FULL REPORT

Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use.

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.