Inflation: Winners and Losers

In the past twelve months, inflation has slowly become one of the greatest issues challenging the global economy. As the Fed has responded with the most aggressive interest rate increases in decades, treasury professionals have an opportunity for higher return potential on their cash investments. However, they need to be aware of the impact inflation may have on the credits in their portfolios, with some industry sectors benefitting from higher prices while others suffer.

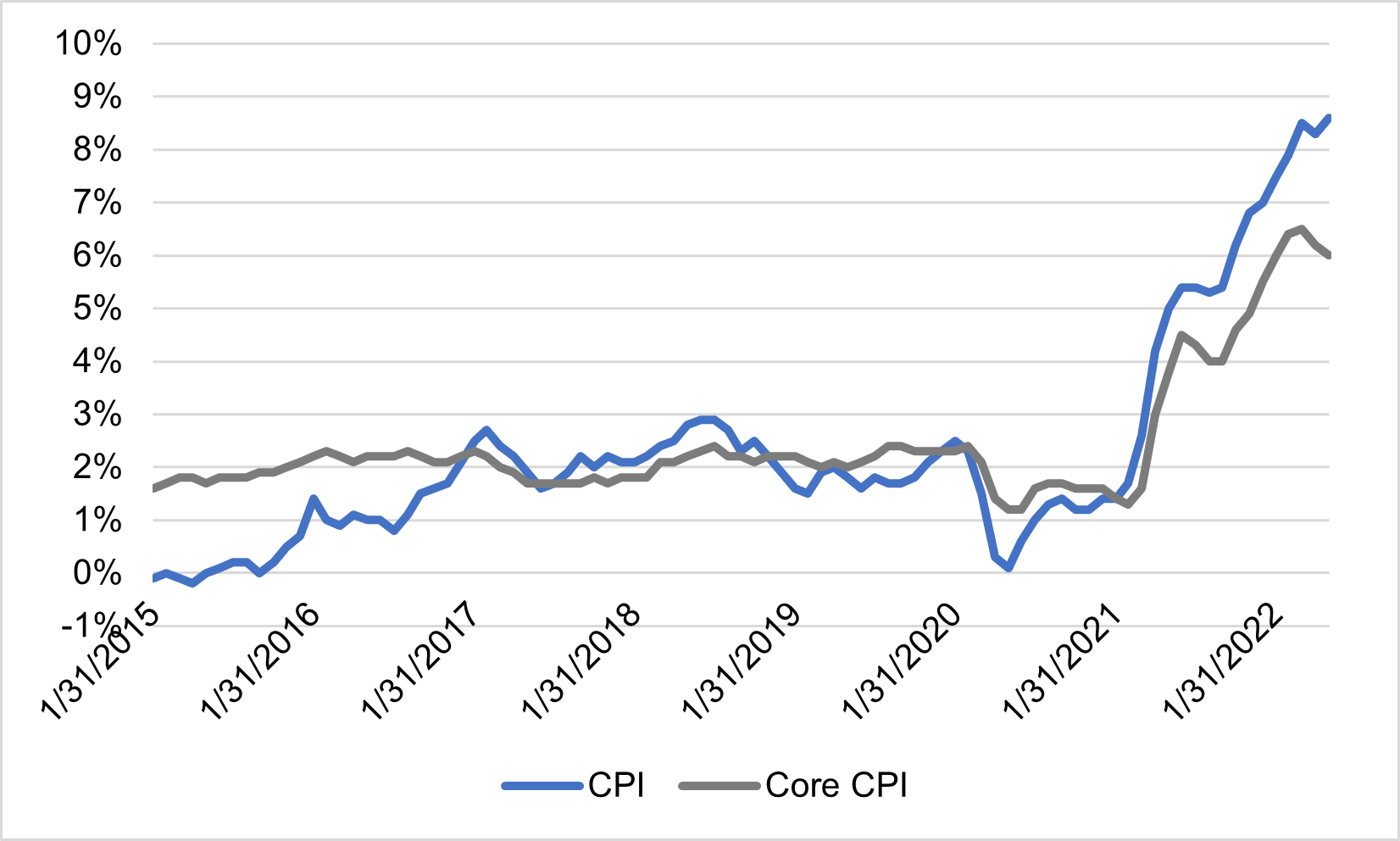

Initially, inflation stemmed from pent-up consumer demand, bolstered by government stimulus, which overwhelmed supply chains. While these pressures showed signs of slowing near the end of 2021, the conflict in Ukraine has exacerbated these pressures, particularly among energy goods and other commodities. As companies’ input costs rose, they continued to increase prices, leading to decades-high inflation. Inflationary pressures once seen as transitory are proving to be rather sticky, particularly for goods that make up sizable portions of consumption. This has led to higher inflation expectations and lower GDP forecasts.

Figure 1: Consumer Price Index, Year-Over-Year Increase

Source: BEA, Bloomberg

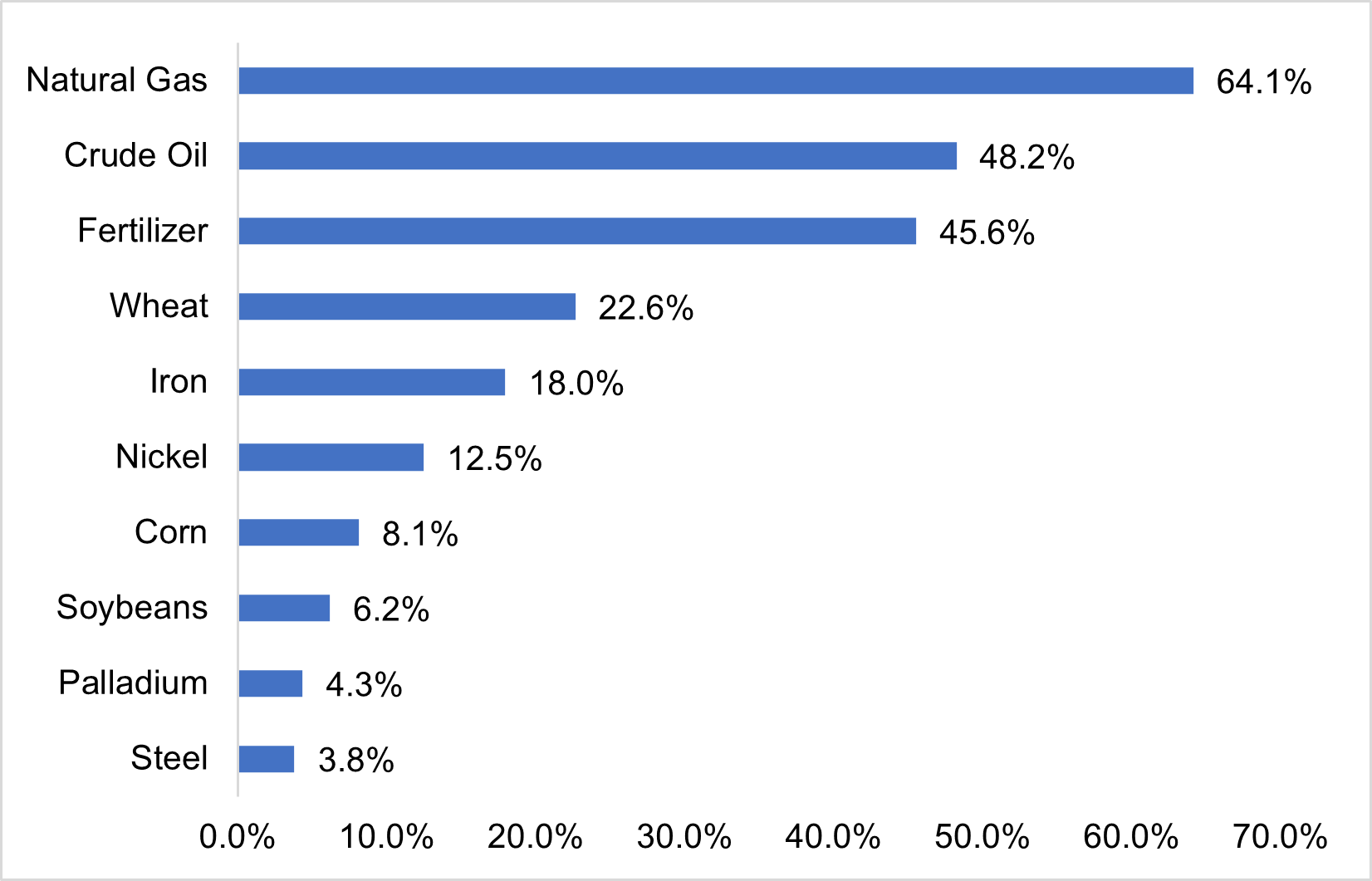

Increased energy prices have been the most prevalent issue stemming from Ukraine conflict. Russia is a major producer of energy, comprising 40-45% of pipeline gas, 11% of crude oil exports, and 18% of coal exports globally.1 Additionally, Russia and Ukraine are large exporters of agricultural goods, including wheat, fertilizer, sunflower, and corn.2 The resulting shortages have translated into higher commodity costs, driving food prices higher. Russia is also a large producer of metals such as nickel, palladium, platinum, aluminum, and copper,3 and the reduction in their supply is affecting manufacturing of durable goods.

Figure 2: YTD Price Increases as of 6/30/2022

Source: Bloomberg

Winners and Losers

The industries most affected by the conflict in Ukraine are sectors that are energy intensive and capital dependent, especially if exposed to the aforementioned commodities. Thus far, producers of commodities impacted by the conflict in Ukraine have benefited from higher prices. Oil and gas companies have profited from higher energy costs in the short-term, with low reserves further adding to costs. However, demand for oil has remained resilient in the short-term, with higher earnings helping to offset impairments to assets and businesses tied to Russia as companies sever their ties to the country. Similarly, producers of agricultural commodities and metals closely tied to Russia and Ukraine have benefited in the short-term from higher prices, which have helped to offset higher costs and shocks to the supply chain. Though these sectors have benefited in the near-term, higher prices will ultimately impact demand as producers adjust their output.

On the flip side, industries that are particularly heavy users of energy, metals, and agricultural commodities saw costs rise significantly in the first quarter of 2022, and the continuing difficulties have dented previously optimistic forecasts. Consumer product manufacturers, who had previously expected cost pressures to ease in 2022, have further raised prices to offset cost inflation from energy, edible oils, and other inputs. Furthermore, automobile manufacturers face cost inflation for key metals such as nickel and palladium and supply bottlenecks related to wiring harnesses manufactured in Ukraine.4 In addition to manufacturers, retailers have also seen higher transportation costs cutting into profits, both from higher energy prices and the additional costs of navigating supply bottlenecks. These challenges have eroded even the largest companies’ ability to incur higher costs while keeping prices low. In response, companies plan to further increase prices as they adjust to the new environment.

The Response

Thus far, consumers have continued to spend despite higher costs. This is in part due to excess levels of savings accumulated in the early stages of the pandemic, as well as a tight labor market driving the fastest nominal wage growth since 1983.5 These factors have enabled businesses to increase their prices without losing customers, supporting growth even if their bottom lines feel the heat.

Figure 3: US Personal Consumption Expenditures (USD bn)

Source: BEA, The Daily Shot (May 30, 2022)

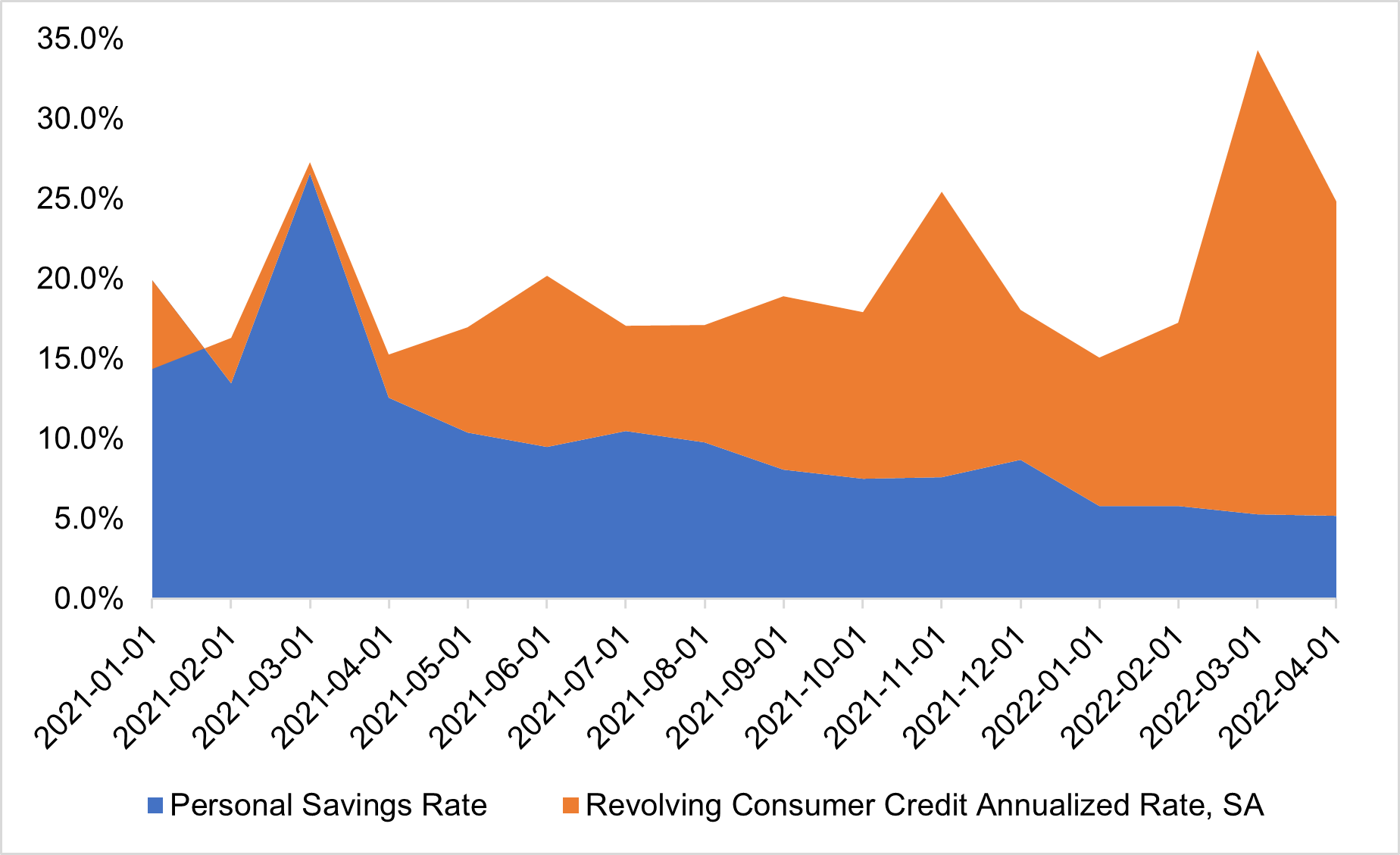

There are signs, however, that consumers are feeling the effects of lasting inflation, which could weigh on global growth. The personal savings rate has fallen below pre-pandemic levels while revolving credit has increased, suggesting that consumers are switching from their debit to their credit cards as inflation takes a bite out of their savings. Moreover, measurements of consumer sentiment have fallen in 2022 as inflation persists, negatively weighing on expectations. If prices rise too much, consumers’ resilience may take a hit, which could reduce discretionary spending. In this scenario, cyclical industries may see a downturn as consumers prioritize spending on staples.

Figure 4: Revolving Consumer Credit Has Risen as Personal Savings Decline

Federal Reserve, Bloomberg

What’s Next?

Ultimately, the underlying drivers of inflation are not expected to dissipate in the near-term, meaning inflation’s dark cloud could remain over consumption and economic growth. While there were expectations that inflation may have peaked following the invasion of Ukraine, the CPI increase reported in May has seemingly dashed these hopes. In turn, this has stirred fears of stagflation for the first time since the 1970s, which is characterized by high inflation, high unemployment, and low economic growth. The Federal Reserve has also increased the pace of rate hikes in attempts to restore price stability, which could drive the economy into recession. The risks stemming from inflation have created uncertainty regarding the course of monetary tightening and economic health.

As inflation pressures corporate earnings and weighs on consumer demand, high-grade credits present good opportunities for cash investors, particularly those who stand to benefit from commodity inflation. Companies with manageable leverage and strong liquidity are better positioned to withstand economic uncertainty, which is particularly crucial for credits most exposed to margin compression. Moreover, many of these firms wield sizable scale and pricing power, better equipping them to rejigger their supply chains and incur higher costs. In particular, defensive industries are likely better protected against downside risk in a cooling economy given consistent demand, with stable cash flows helping to offset higher input costs.

In response to high inflation, the Fed began raising interest rates in March and is expected to continue this tightening cycle throughout the year. This will increase the yield on short-term securities, but also create tighter credit conditions, which would mostly impact high-yield credits. Ultimately, in a period of high inflation it may be prudent for cash investors to position their portfolios into short-term, high-grade names to weather these challenges while maximizing liquidity and yield return potential.

1https://live.barcap.com/PRC/publication/DR/CL_TEJ-IH4gfiB-IH4g_623bbe02a31e237df3432c83

3https://www.bloomberg.com/graphics/2022-russia-commodities-shortage/

4https://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1326788

Please click here for disclosure information: Our research is for personal, non-commercial use only. You may not copy, distribute or modify content contained on this Website without prior written authorization from Capital Advisors Group. By viewing this Website and/or downloading its content, you agree to the Terms of Use & Privacy Policy.